As your family grows, so do your responsibilities. From the birth of your first child to managing the financial needs of your household, each milestone requires careful planning and decision-making, particularly when it comes to insurance. For new and growing families, the importance of securing the right insurance coverage cannot be overstated. Insurance isn’t just a safety net—it’s a fundamental part of protecting your loved ones, assets, and future. But with the overwhelming number of options available, how do you know what’s best for your unique needs?

The primary purpose of insurance is to provide financial security in the face of unexpected events. Whether it’s the loss of a primary income earner, a medical emergency, or damage to your home, insurance steps in to mitigate the financial burden. This peace of mind is essential as you navigate the joys and challenges of raising a family.

For a growing family, the right insurance coverage will protect more than just your physical health; it ensures that your family’s financial future remains intact, even during difficult times. When you’re responsible for the health and wellbeing of your children, elderly relatives, and potentially even your spouse, having adequate insurance coverage provides an essential layer of protection. It also helps you plan for the future, whether that means college tuition for your kids or retirement for you.

The financial landscape can change rapidly—unexpected medical bills, auto accidents, or even natural disasters can wreak havoc on family finances. Insurance provides a buffer that helps prevent these events from becoming financial crises. Without insurance, many families may be forced to take on overwhelming debt, delay medical treatments, or even lose their homes. Insurance ensures that in these situations, you have a plan in place.

As your family grows, it’s important to review and adjust your insurance needs regularly. The policies that worked for you when you were a couple may no longer be sufficient to cover your family’s new responsibilities. A growing family means more assets to protect, more people to cover, and more risks to manage. In this article, we’ll explore how to choose the best insurance policies for your growing family, from health to life insurance, and offer guidance on assessing your needs along the way.

Choosing the right insurance doesn’t have to be overwhelming, but it does require careful thought and understanding. You’ll want to ensure that you select the right types of coverage and amounts, while balancing your budget and your family’s future needs. To help, we’ll break down the key types of family insurance, what to look for, and how to make informed decisions based on your unique situation.

Understanding the Different Types of Family Insurance

When it comes to insurance, there’s no one-size-fits-all approach. The insurance policies that are best for your family depend on many factors, such as your lifestyle, financial goals, and current circumstances. Here’s a closer look at the key types of insurance every growing family should consider:

Life Insurance

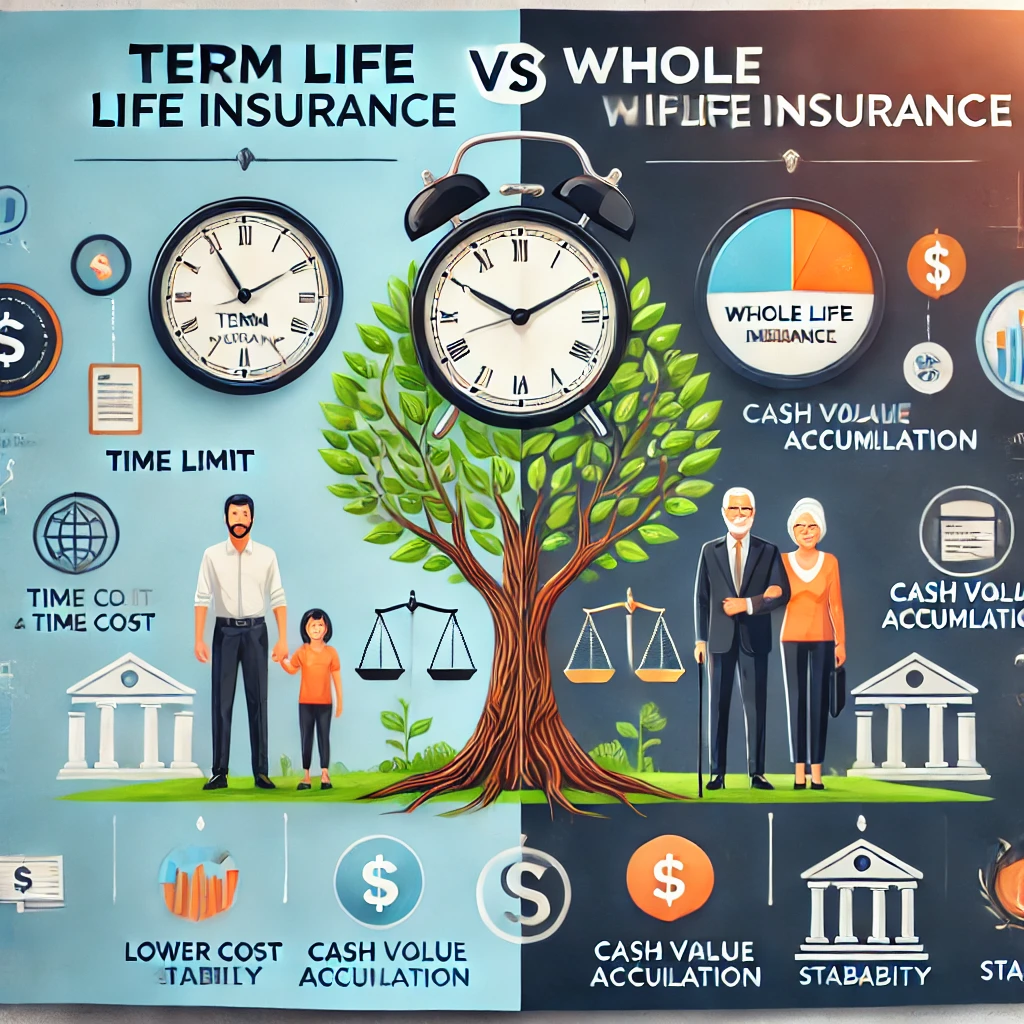

Life insurance is one of the most important types of insurance for families. It ensures that if a primary breadwinner passes away unexpectedly, the family is financially supported. Life insurance comes in two main types: term life and whole life. Term life is more affordable and provides coverage for a set period, while whole life offers lifetime coverage with an investment component.

For growing families, life insurance is vital for replacing lost income, covering debts, and ensuring that your children’s education and future are secure. It’s particularly essential if you have young children who would be financially dependent on you for many years.

Health Insurance

Health insurance is crucial for protecting your family from the high cost of medical bills. It covers expenses related to doctor visits, hospital stays, surgeries, medications, and preventive care. There are two main types of health insurance: employer-sponsored plans and individual plans. Health insurance is particularly important for growing families, as children need regular checkups, vaccinations, and sometimes more extensive medical care as they grow.

Choosing a health insurance plan that offers adequate coverage, affordable premiums, and access to a network of healthcare providers can be challenging. However, it’s important to review your family’s medical needs and select a plan that meets those needs while staying within your budget.

Auto Insurance

Auto insurance is required by law in most states, but it’s also important for protecting your family’s assets in case of an accident. Auto insurance typically includes liability, collision, and comprehensive coverage. Liability insurance covers damages to other vehicles or property, while collision and comprehensive cover repairs to your own vehicle in case of an accident or damage from weather or theft.

For growing families, auto insurance becomes even more critical as the number of vehicles increases and your children may eventually start driving. Understanding your coverage options and ensuring you have adequate protection is essential to avoid financial strain if an accident occurs.

Homeowner’s Insurance

Homeowner’s insurance is vital for protecting your home and personal belongings from damage or loss. This includes damage from fire, theft, vandalism, or natural disasters like floods or earthquakes. Homeowner’s insurance also provides liability coverage in case someone is injured on your property.

As your family grows, your home becomes even more valuable—not only for the memories created inside but also as an investment. Choosing the right homeowner’s insurance ensures that your family is protected in case of unexpected damages.

Disability Insurance

Disability insurance is designed to replace a portion of your income if you become unable to work due to an illness or injury. This type of insurance is often overlooked, but it’s important for families who rely on two incomes or who are the primary breadwinner. Disability insurance can prevent financial hardship in case of an accident or serious health condition that prevents you from working.

It’s particularly valuable for families with young children or those with large financial responsibilities, as it ensures that you won’t lose your ability to earn income during a time of hardship.

Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond what your auto or homeowner’s policies cover. This is particularly useful if you have significant assets or risks that may result in a lawsuit. Umbrella insurance can protect your family from the financial consequences of lawsuits or large claims that exceed the limits of your primary insurance.

This type of insurance can be especially important as your family grows and acquires more assets, such as a home, cars, or savings. It provides an extra layer of security in case of unexpected events that could lead to significant financial exposure.

Long-Term Care Insurance

As your parents or elderly relatives age, you may need to consider long-term care insurance. This type of insurance helps cover the cost of long-term care services, including nursing homes or in-home care, which can be a financial burden without insurance. Growing families often need to balance their own financial goals with caring for aging parents, and long-term care insurance can make that balance easier to manage.

Travel Insurance

If your family enjoys traveling, especially internationally, travel insurance can be a helpful addition. Travel insurance covers unexpected expenses during travel, such as medical emergencies, lost luggage, or trip cancellations. This can provide peace of mind when planning family vacations or business trips.

Each of these insurance types plays a role in safeguarding your family’s financial future. As your family grows, so will your needs, and it’s important to regularly review your policies to ensure that your coverage keeps pace with your changing circumstances.

Assessing Your Family’s Needs

When it comes to choosing the right insurance for your family, understanding your unique needs is crucial. Every family has different circumstances, priorities, and financial goals, and your insurance decisions should reflect these factors. Here are some steps to help you assess your family’s needs:

Evaluate Your Current Financial Situation

Before selecting insurance policies, take a close look at your family’s current financial situation. How much income do you bring in, and what are your current expenses? Are you saving for long-term goals like retirement or your children’s education? Understanding your family’s financial picture will help you make informed decisions about how much coverage you need and what you can afford.

Consider Your Family’s Health

The health needs of your family are a major factor in choosing the right insurance. If you have young children, for example, you may need a health insurance plan that offers robust pediatric care and regular checkups. For families with members who have ongoing medical conditions, it’s essential to consider policies that provide coverage for specific treatments, medications, or specialist care.

Plan for Major Life Events

Consider upcoming life events that may change your insurance needs. Are you planning to expand your family, buy a home, or retire soon? Each of these events may require you to adjust your insurance coverage. For example, if you’re planning to buy a home, you’ll need to evaluate your homeowner’s insurance needs, while an expanding family might prompt a review of your life insurance and health insurance policies.

Understand the Risks You Face

Different families face different risks. If you live in an area prone to natural disasters, you might need additional coverage for flood or earthquake damage. If you work in a dangerous profession or have a high-risk lifestyle, you may need to consider extra life or disability insurance. Understanding the risks you face as a family will help you choose the right insurance policies to protect against them.

Look at Your Dependents

Consider who depends on your income and support. If you have young children, their future needs should be considered when selecting life insurance. Similarly, if you have elderly parents or family members with special needs who rely on your support, you may need additional coverage to ensure their well-being in case something happens to you.

Determine Your Risk Tolerance

Every family has a different level of risk tolerance. Some families are more comfortable with taking on risk and may opt for lower premiums with higher deductibles, while others prefer to have more comprehensive coverage for peace of mind. Understanding your own risk tolerance will help you choose the right insurance policy and coverage levels.

Factor in Future Goals

Think about your long-term financial goals. Are you saving for college tuition for your children or planning for a comfortable retirement? Your insurance choices should align with these goals. For example, life insurance can ensure that your children’s college education is funded if something were to happen to you, while a solid health insurance policy can prevent large medical bills from interfering with your savings.

Evaluating Life Insurance Options

When selecting life insurance for your growing family, it’s essential to understand the different types of policies available and how they align with your family’s needs. Life insurance provides financial security for your loved ones if something were to happen to you. It helps cover lost income, pay off debts, and provide for your family’s future needs. But with a variety of options to choose from, deciding on the right one can be overwhelming. Here’s a breakdown of the two primary types of life insurance, and how to evaluate them based on your family’s situation.

Term Life Insurance: A Simple and Affordable Option

Term life insurance is often the best choice for families on a budget. It offers coverage for a set period, such as 10, 20, or 30 years, at a lower premium than whole life insurance. During the term of the policy, if the insured person passes away, their beneficiaries receive the death benefit. However, once the term ends, the policy expires, and there’s no payout if the insured person is still alive.

For a growing family, term life insurance offers an affordable way to ensure your loved ones are financially protected. It’s ideal if your primary concern is replacing lost income for a specified number of years—such as until your children are grown and financially independent or until your mortgage is paid off. The key advantage is that it allows you to secure a large death benefit without paying high premiums.

Whole Life Insurance: Lifetime Coverage with Cash Value

Whole life insurance provides coverage for your entire life, as long as you continue to pay premiums. Unlike term life insurance, it also includes a cash value component, which grows over time and can be borrowed against or used to pay premiums. The premiums are higher than those of term life insurance, but they remain fixed throughout the life of the policy.

Whole life insurance is often recommended for families who want lifetime coverage and are looking to build a cash value asset that could be accessed later in life. It can also be a tool for estate planning, as the death benefit can help cover estate taxes or pass wealth to your heirs. However, because of the higher premiums, it’s important to assess whether the investment component aligns with your family’s financial goals.

Determining How Much Coverage You Need

Once you’ve decided on the type of life insurance, the next step is to determine how much coverage you need. The amount of life insurance you should purchase depends on several factors:

Income Replacement: How much income does your family need to maintain their lifestyle if you were no longer there? A common recommendation is to have 10–12 times your annual income in life insurance coverage, though this amount can vary depending on your family’s specific needs.

Debt: Consider your outstanding debts, including mortgages, car loans, and credit card balances. Life insurance can help pay off these debts, ensuring your family isn’t burdened by them.

Future Expenses: Think about future financial needs, such as your children’s education, medical care, and retirement savings. Life insurance can help cover these long-term costs.

Special Circumstances: If you have dependents with special needs or elderly parents who rely on your financial support, you may need additional coverage to ensure their well-being.

Is Life Insurance Necessary for Stay-at-Home Parents?

While life insurance is often associated with the primary breadwinner, it’s also important for stay-at-home parents. Stay-at-home parents contribute significantly to the family by managing the household, caring for children, and taking on other duties that allow the working spouse to focus on their job. If something were to happen to a stay-at-home parent, the surviving spouse would likely face additional childcare and household responsibilities, which could be costly.

In these cases, a smaller life insurance policy could be a smart decision. It ensures that the surviving spouse can afford to hire help or take time off from work to manage the household.

Riders and Additional Features

Life insurance policies can come with additional features or “riders” that provide extra protection. Common riders include:

Accelerated Death Benefit: This allows you to access a portion of the death benefit if you’re diagnosed with a terminal illness.

Waiver of Premium: If you become disabled and can’t work, this rider waives the premiums on your policy while maintaining your coverage.

Child Rider: This rider provides coverage for your children in case of an unexpected tragedy. It can also offer an extra benefit in case of serious illness or injury to a child.

These riders can offer peace of mind and additional flexibility, but be sure to assess whether they’re worth the extra cost based on your family’s needs.

Periodically Review Your Life Insurance Policy

As your family grows and changes, your life insurance needs may shift. You may need to increase your coverage if you have more children or take on new debts. Alternatively, if you’ve paid off your mortgage or your children are financially independent, you may be able to reduce your coverage. It’s essential to review your policy regularly to ensure that it still meets your family’s needs.

Choosing Health Insurance for Your Family

Health insurance is arguably one of the most critical types of insurance you’ll need as your family grows. A good health insurance plan not only ensures access to quality medical care but also helps protect your family from financial hardship caused by unexpected medical expenses. However, with so many health insurance options available, how do you choose the right plan for your family’s needs?

Employer-Sponsored Insurance vs. Marketplace Plans

Most families get their health insurance through their employer, but this isn’t the only option. Employer-sponsored health insurance often comes with lower premiums because the employer shares the cost. However, these plans may have limited options in terms of coverage or doctors within the network.

If your employer doesn’t offer health insurance or you need a different plan, you can explore options through the Health Insurance Marketplace, which provides a range of private insurance plans. Depending on your income, you may also qualify for subsidies to reduce your premiums or out-of-pocket costs.

When evaluating health insurance options, compare both employer-sponsored plans and marketplace plans to determine which offers the best coverage and affordability for your family. Look for plans that include essential health benefits like maternity care, pediatric care, and mental health services.

Coverage for Preventive Care and Routine Checkups

For a growing family, preventive care should be a priority. Health insurance plans must cover certain preventive services without charging you a copayment or coinsurance. These services include immunizations, screenings, and annual checkups. If you have young children, choosing a plan that covers pediatric care, vaccinations, and routine checkups is essential.

Having access to preventive care not only helps catch potential health issues early but also helps manage your family’s overall health in a cost-effective way. As you compare health insurance plans, ensure that they offer comprehensive coverage for preventive services without excessive out-of-pocket costs.

Out-of-Pocket Costs: Understanding Deductibles, Copayments, and Coinsurance

When choosing a health insurance plan, it’s essential to consider out-of-pocket costs, including premiums, deductibles, copayments, and coinsurance. While premiums represent the monthly cost of your insurance, deductibles are the amount you must pay before your insurance kicks in. Copayments and coinsurance are your share of medical costs after your deductible is met.

For growing families, it’s important to choose a plan that balances affordable premiums with manageable out-of-pocket expenses. You’ll want a plan that provides adequate coverage without putting undue strain on your finances. Consider your family’s health history and how frequently you’ll need to visit the doctor or fill prescriptions when determining your out-of-pocket costs.

Access to a Network of Healthcare Providers

Most health insurance plans operate within a network of doctors, hospitals, and specialists. When selecting a plan, it’s important to ensure that your family’s primary care doctor and any specialists you need are included in the network. Going out-of-network can result in higher out-of-pocket costs or even denied claims.

If you have a preferred pediatrician, family doctor, or specialist, check to see if they are part of the insurer’s network before committing to a plan. If you have a preferred hospital or clinic, ensure that the plan covers care at these facilities as well.

The Need for Prescription Drug Coverage

Prescription medications can become a significant part of your family’s healthcare expenses, especially if you have children who need regular medications or if any family members have chronic conditions. Ensure that the health insurance plan you choose includes coverage for necessary prescription drugs.

Some plans have formulary lists, which categorize medications into different tiers based on cost. Be sure to check whether the medications your family relies on are included in the plan’s formulary and whether the plan’s drug costs are manageable.

Factors to Consider When Selecting a Family Health Insurance Plan

Choosing the right health insurance plan for your family goes beyond just selecting the one with the lowest premium. It’s about finding a plan that meets your family’s medical needs, fits within your budget, and provides access to the best care possible. When evaluating family health insurance options, there are several important factors to consider.

1. Coverage for Essential Health Services

Health insurance plans are required to cover a set of essential health benefits, but the level of coverage can vary. For a growing family, coverage for services like pediatric care, maternity care, mental health services, and preventive care is essential. Review the plan to ensure it includes these services, as well as others such as prescription drug coverage, emergency services, and specialist care.

2. Choosing Between HMO, PPO, and EPO Plans

Health insurance plans typically fall into one of three categories: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or Exclusive Provider Organization (EPO). Each plan type has distinct pros and cons.

HMO Plans: These plans are generally more affordable, but they require you to get care from in-network providers. If you need to see a specialist, you’ll typically need a referral from your primary care doctor.

PPO Plans: PPO plans offer more flexibility. You can see any doctor or specialist without a referral, but your out-of-pocket costs will be higher if you go out of network.

EPO Plans: EPOs are similar to PPOs but with more restricted networks. They don’t require referrals but don’t cover out-of-network care, except in emergencies.

Your family’s medical needs and preferences for flexibility in care should guide your decision on which plan type to choose.

3. Premiums vs. Deductibles

When choosing a plan, consider the trade-off between premiums and deductibles. Premiums are the monthly costs you pay for health insurance, while deductibles are the amount you must pay out-of-pocket before your plan starts covering expenses. A plan with a low premium may have a high deductible, meaning you’ll pay more out-of-pocket before your insurance covers much of your medical costs.

For families with young children who are likely to require frequent doctor visits or prescriptions, a plan with a lower deductible may be more cost-effective, even if it has higher premiums. On the other hand, if your family is generally healthy and doesn’t expect many medical expenses, a plan with a higher deductible but lower premiums may work well.

4. Out-of-Pocket Costs: Copays, Coinsurance, and Maximums

Understanding the out-of-pocket costs associated with a health insurance plan is crucial. Copays are fixed amounts you pay for certain services, like doctor visits or prescriptions. Coinsurance is the percentage of a medical bill that you must pay after meeting your deductible. Some plans also have out-of-pocket maximums, which limit the total amount you’ll have to pay for covered services in a year.

Evaluate your family’s likely health care needs to determine which out-of-pocket structure makes the most sense. For example, if you expect a lot of doctor visits, a plan with lower copays may be beneficial. Also, make sure you understand the maximum out-of-pocket costs, as this can significantly affect your financial situation if you have a major medical event.

5. Access to a Broad Network of Providers

Having access to a wide range of healthcare providers can be especially important when you have a growing family. Whether it’s finding a pediatrician, a specialist for chronic conditions, or urgent care when your child is sick, you’ll want to ensure that your health insurance plan includes a wide network of doctors and hospitals.

If you have preferred healthcare providers or specialists, check whether they’re included in the insurance company’s network. Out-of-network care can be more expensive, and in some cases, it may not be covered at all, so having access to a network that meets your needs is critical.

6. Preventive and Wellness Benefits

Growing families should prioritize preventive care, as regular checkups, screenings, and vaccinations are key to staying healthy. Many health insurance plans cover preventive services at no cost to you, which is an excellent benefit for families with children.

When reviewing health plans, ensure that they offer comprehensive preventive benefits, including well-child visits, immunizations, and screenings for chronic conditions like asthma, diabetes, or high cholesterol. Additionally, some plans offer wellness programs, discounts on gym memberships, or access to health coaching, which can be beneficial for maintaining a healthy lifestyle as a family.

7. Maternity and Newborn Care Coverage

If you’re planning to grow your family, maternity care should be a top priority when choosing a health insurance plan. Many insurance plans cover prenatal care, delivery, and postnatal care, but coverage levels and provider networks may vary. Ensure that the plan provides comprehensive maternity care, including hospital stays, prenatal vitamins, and access to maternal health specialists if needed.

Additionally, check for coverage related to newborn care. This can include vaccinations, screenings, and pediatric care in the early months after birth. If you anticipate adding to your family soon, it’s essential that your plan includes these benefits.

8. Prescription Drug Coverage

Prescription medications are an integral part of many family health plans, especially if any family members rely on medication for ongoing conditions. When reviewing plans, check the formulary (list of covered drugs) to ensure that the medications your family takes are included.

Consider whether the plan offers coverage for both generic and brand-name drugs and whether there are any tiered costs associated with prescriptions. Some plans may have higher out-of-pocket costs for certain medications, so you’ll want to weigh this against the plan’s overall cost.

9. Flexibility and Special Programs

Some health insurance plans offer extra features like telehealth services, mental health coverage, and wellness programs that can be valuable for a growing family. Telehealth services allow you to consult a doctor remotely, which can be a huge benefit if you have young children or a busy family life.

Additionally, many health plans now offer enhanced mental health services, which are increasingly important in managing stress, depression, and anxiety—issues that can affect parents and children alike. Look for plans that offer a broad array of services to support your family’s overall health and well-being.

Understanding Auto Insurance Needs for Your Growing Family

As your family expands, so does your need for reliable transportation. Whether you’re commuting to work, running errands, or taking family vacations, your car becomes a central part of daily life. Auto insurance is a critical aspect of ensuring that you and your family are protected in the event of an accident. But how do you choose the right coverage?

1. Basic Coverage: Liability, Collision, and Comprehensive Insurance

Auto insurance generally includes three main types of coverage: liability, collision, and comprehensive insurance. Liability insurance covers damages to other people or property in the event of an accident where you’re at fault. This is required by law in most states. Collision insurance covers damage to your own vehicle in the event of a collision, regardless of fault. Comprehensive insurance covers non-collision incidents, such as theft, vandalism, or weather-related damage.

For growing families, it’s crucial to have sufficient coverage to protect both your vehicle and others. Liability insurance is the bare minimum, but if you have a newer or more valuable car, collision and comprehensive coverage provide an extra layer of protection.

2. Increasing Your Coverage as Your Family Grows

As your family expands, so do your car-related needs. You may find yourself purchasing a larger vehicle to accommodate more passengers or more belongings. If your car’s value increases, you may want to consider increasing your coverage to ensure that you’re adequately protected.

Additionally, if your children start driving, you’ll need to add them to your policy. Teen drivers can significantly impact your insurance rates, so it’s important to shop around for the best possible coverage for your growing family. Many insurers offer discounts for good student drivers, so be sure to ask about potential savings.

3. Multi-Vehicle Policies and Discounts

If you own more than one vehicle, it’s often more cost-effective to bundle your car insurance policies under one provider. Many insurance companies offer multi-car discounts, which can save you money on premiums.

This is especially beneficial for families with multiple drivers, as the cost of adding another car to your policy is typically less than purchasing separate coverage for each vehicle. Review the available discounts and check if bundling your auto insurance with other types of insurance, like homeowner’s or life insurance, can further reduce your overall premiums.

4. Considerations for Family-Friendly Vehicle Coverage

When selecting auto insurance for your growing family, take into account the type of vehicle you drive. Some insurers offer discounts for family-friendly cars with advanced safety features, such as automatic braking, lane-keeping assist, or adaptive cruise control.

If you’re in the market for a new vehicle, look for safety ratings from organizations like the National Highway Traffic Safety Administration (NHTSA) or the Insurance Institute for Highway Safety (IIHS). Some insurance companies provide lower rates for vehicles that score highly in crash tests or have advanced safety features, which could save you money on premiums.

5. Personal Injury Protection (PIP) and Medical Payments Coverage

In the event of an accident, Personal Injury Protection (PIP) or medical payments coverage can help cover medical bills for you and your passengers, regardless of fault. These types of coverage are especially important for families, as they can provide immediate financial relief if someone in the family is injured in a car accident.

PIP may also cover other costs related to an accident, such as lost wages, child care, or funeral expenses. This type of coverage is typically available in states that have “no-fault” insurance laws, where each driver’s insurance pays for their own medical expenses in an accident, regardless of who caused it.

Homeowner’s Insurance: Protecting Your Family’s Home and Assets

As your family grows, the importance of securing your home and personal belongings becomes even more evident. Homeowner’s insurance is one of the most vital types of coverage you’ll need. It provides financial protection in case your home is damaged or destroyed by unforeseen events like fire, storms, theft, or vandalism. Here’s how to ensure that you’re properly covered.

1. Understanding Homeowners Insurance Basics

Homeowner’s insurance generally covers three major areas: the structure of your home, your personal belongings, and liability. Dwelling coverage helps repair or rebuild your home in case it is damaged by a covered event. Personal property coverage protects your belongings, such as furniture, electronics, and clothing. Liability coverage helps protect you if someone is injured on your property or if you accidentally cause damage to someone else’s property.

As your family grows, you’ll accumulate more personal belongings, so it’s crucial to review your coverage limits regularly to ensure that they are adequate. If you have valuable items like jewelry, electronics, or collectibles, you may need to consider additional coverage to protect these items fully.

2. Choosing the Right Coverage Amount

When selecting a homeowner’s insurance policy, it’s important to determine how much coverage you need. Replacement cost coverage, which is typically recommended, will help you rebuild your home and replace your belongings at current prices, regardless of depreciation. On the other hand, actual cash value coverage considers depreciation, meaning the payout may be less if your property loses value over time.

For a growing family, opting for replacement cost coverage is typically the better option, as it ensures that you’ll have enough funds to rebuild and replace everything in the event of a disaster, without being penalized by depreciation.

3. Special Coverage for Natural Disasters

Depending on where you live, you may need additional coverage for natural disasters that aren’t typically included in a standard homeowner’s policy, such as flood insurance or earthquake coverage. For example, if you live in a flood-prone area, your regular policy will likely not cover water damage, so purchasing a separate flood insurance policy is necessary.

Similarly, if you live in an earthquake zone, you may need to buy separate earthquake insurance to protect your home and belongings in the event of a quake. Always review your risks and ensure that your homeowner’s insurance offers the coverage you need for specific natural disasters.

4. Liability Protection for Accidents and Injuries

Liability coverage is an essential part of homeowner’s insurance because it can protect your family from significant financial loss in the event of an accident. For instance, if someone is injured on your property—say a guest slips on a wet floor or your dog bites someone—liability insurance can help cover medical bills, legal fees, and damages awarded to the injured party.

For growing families, liability coverage is particularly important, as children and pets can sometimes lead to unexpected accidents. It’s worth considering increasing your liability limits if you have young children or a larger-than-usual home where accidents might be more likely to happen.

5. Home Security Systems and Discounts

Many homeowner’s insurance companies offer discounts if you have a home security system in place. Adding smoke detectors, fire alarms, and burglar alarms can reduce your premiums because these systems lower the risk of damage or loss to your home. For families with young children, having these systems can provide an added layer of protection, giving peace of mind in case of emergencies.

If you already have security systems in place, make sure you notify your insurer, as some may offer substantial discounts. Additionally, some insurance policies offer discounts for features like deadbolt locks, a fire extinguisher, or impact-resistant roofing.

6. Flood and Water Damage Protection

Water damage is one of the leading causes of homeowner’s insurance claims. A standard policy usually covers damage caused by burst pipes or fire-fighting efforts, but it won’t cover damage caused by flooding or sewer backups. If you live in an area prone to heavy rainfall, snowmelt, or rising waters, you may need to purchase additional flood insurance.

Water damage can be particularly devastating for growing families because it often damages personal property such as furniture, electronics, and family heirlooms. Additionally, repairs can be costly and time-consuming. Having adequate flood and water damage coverage can prevent you from facing major financial strain if an unexpected disaster strikes.

7. Home Renovations and Updates

As your family grows, you may undertake home renovations or improvements, such as adding rooms or remodeling the kitchen. If these changes significantly increase the value of your home, it’s essential to update your homeowner’s insurance policy to reflect the new value.

Some renovations, such as adding a pool or deck, may require additional coverage. Be sure to speak with your insurance provider about any changes to your home that could affect your policy. Neglecting to update your insurance after renovations could result in inadequate coverage if damage or loss occurs.

8. Additional Living Expenses Coverage

If your home becomes uninhabitable due to a covered event (such as a fire or storm), homeowners insurance may help cover the costs of living elsewhere temporarily. This is called Additional Living Expenses (ALE) coverage. ALE can pay for things like hotel stays, meals, and transportation while your home is being repaired or rebuilt.

For families, this coverage can be particularly valuable. With children, relocating temporarily can be challenging, so having your expenses covered will ease the financial strain. Always check your ALE coverage limits to ensure they are adequate for your family’s needs.

9. Periodic Review of Coverage Needs

Homeownership needs evolve as your family grows, and so should your homeowner’s insurance policy. Review your coverage periodically to make sure it’s keeping pace with changes in your home and lifestyle. For example, if you’ve accumulated more personal property or your home’s value has appreciated, you may need to adjust your policy to reflect these changes.

Considering Disability Insurance for Income Protection

As a growing family, protecting your income in the event of illness or injury is vital. Disability insurance provides income replacement if you are unable to work due to a short- or long-term disability. While it may not be top of mind for many, it’s one of the most important forms of insurance you can have when raising a family.

1. Short-Term vs. Long-Term Disability Insurance

Disability insurance typically falls into two categories: short-term and long-term. Short-term disability insurance usually provides benefits for a few weeks to a few months after an illness or injury. It covers a portion of your income until you can return to work. Long-term disability insurance, on the other hand, kicks in after short-term coverage ends and can provide benefits for years or even until you reach retirement age.

If you’re the primary breadwinner in your family, having both types of coverage can ensure your family is protected in the event of an accident or illness. Short-term disability coverage is essential for immediate needs, while long-term coverage provides financial security over time.

2. Income Replacement and Benefits

The primary benefit of disability insurance is income replacement. Typically, disability insurance will replace about 60–70% of your pre-disability income. While this isn’t the full amount, it can make a significant difference in covering living expenses and maintaining your family’s lifestyle while you recover from a disability.

When selecting a policy, consider how much of your income you would need to maintain your family’s financial security. If you have significant savings or other sources of income, you may need less coverage, but for most families, it’s essential to cover a substantial portion of your income.

3. Understanding Elimination Periods

Disability insurance policies include an elimination period, which is the waiting time before you can start receiving benefits. Short-term disability insurance typically has a shorter waiting period (usually a few days or weeks), while long-term policies may have longer waiting periods (a few months or more).

It’s important to assess your financial situation and decide whether you can afford to wait for benefits to kick in. If you don’t have enough savings to cover living expenses during the elimination period, you may want to opt for a shorter waiting period, though this could increase your premium.

4. Considering Employer-Sponsored vs. Private Disability Insurance

Many employers offer disability insurance as a part of their benefits package. Employer-sponsored policies are often more affordable, but they may have limitations on coverage or may not offer long-term coverage. If your employer offers disability insurance, review the policy carefully to see if it’s sufficient for your family’s needs.

If your employer doesn’t offer disability insurance or the coverage is inadequate, you can purchase a private disability insurance policy. Private policies tend to offer more flexibility and higher coverage limits, but they can be more expensive.

Evaluating the Cost of Insurance for Your Family

As your family grows, so too do the demands on your household budget. Insurance, while essential, can become a significant part of your financial commitments. Evaluating the cost of insurance is crucial to ensure that you are getting the best coverage without overstretching your budget. Here’s how to balance quality insurance with affordability.

1. Understand Your Insurance Needs Before Shopping Around

Before diving into insurance shopping, it’s important to take stock of your family’s needs. Review the types of insurance your family requires, such as health, life, auto, homeowner’s, disability, and any other coverage you might need. Once you have a clear understanding of your needs, you can begin evaluating policies that meet those requirements.

Having a checklist can help you ensure that you’re not over-insuring or under-insuring. For example, if you’re a healthy family with young children, you may not need extensive life insurance, but a solid health insurance policy and home insurance with adequate liability coverage should be a priority.

2. Shop Around for the Best Deals

Insurance premiums can vary widely between providers, so it’s always worth shopping around to compare rates. Start by collecting quotes from at least three different insurers. Make sure that you’re comparing the same level of coverage and coverage types for a fair comparison. Some insurance companies offer discounts for bundling policies, so check to see if you can combine multiple types of coverage for a more affordable rate.

When looking for the best deal, don’t just consider the monthly premiums. Look closely at the deductibles, copays, and out-of-pocket costs, as these can have a major impact on the total cost of insurance over time. Often, a lower premium will come with a higher deductible or more limited coverage, so weigh all factors when making your decision.

3. Factor in the Costs of Premiums and Deductibles

While premiums are the most visible cost, your out-of-pocket expenses such as deductibles, copayments, and coinsurance can add up over time. For example, if you choose a health insurance plan with a low premium, but it comes with a high deductible and higher out-of-pocket costs, you could end up spending more in the long run, especially if your family requires frequent medical care.

When choosing your insurance plans, evaluate both the premium and the deductible. For a growing family with young children, it’s often beneficial to go for a plan with a higher premium and lower deductible if you expect frequent medical expenses, as this may save you more money overall.

4. Assess Your Risk Tolerance

Each type of insurance comes with an inherent risk that you’ll need to decide how much you’re willing to accept. For example, with health insurance, you may choose a plan with a lower premium but higher out-of-pocket costs, assuming that you won’t need much medical care in the coming year. Alternatively, you may prefer to pay higher premiums to ensure lower deductibles and copayments, offering peace of mind in case of an emergency or unexpected medical need.

Similarly, with auto or home insurance, you may decide to opt for higher coverage limits for greater protection or accept a higher deductible to lower your premium payments. Ultimately, your risk tolerance should guide your decisions when choosing insurance coverage.

5. Maximize Employer Benefits

Many employers offer benefits packages that include life, health, and disability insurance, which can be much more affordable than purchasing insurance independently. Employer-sponsored health insurance, in particular, is a great option since employers often cover a large portion of the premium.

Take full advantage of any insurance benefits offered by your employer. Be sure to understand the specifics of the plans they provide and determine whether they cover your family’s needs. If your employer offers additional benefits like life insurance or disability coverage, consider whether adding these to your benefits package makes sense for your family.

6. Adjust Coverage as Your Family’s Needs Evolve

As your family grows, so will your insurance needs. For example, if you have more children or take on a new mortgage, your life and home insurance coverage may need to be increased. Likewise, as your children age, your auto insurance premiums may go up due to the addition of teenage drivers, or your health insurance needs may shift as your family’s medical requirements change.

Review your policies annually and adjust your coverage as needed. Keeping track of life changes, such as a new baby or a job change, can help you evaluate whether you’re paying for coverage you no longer need or if you need to add more to your policy.

7. Look for Discounts and Savings Opportunities

Many insurance companies offer discounts that can help reduce the cost of coverage. For example, you may be eligible for discounts based on your driving history, home security systems, bundling policies, or even your profession. Additionally, some health insurers offer savings for completing wellness programs, going for annual checkups, or taking part in fitness challenges.

Make sure to ask your insurance provider about potential discounts and regularly check if any new savings opportunities are available. It’s easy to overlook savings that could add up to significant reductions in your premiums.

8. Understand the Total Cost of Insurance Over Time

When considering the cost of insurance, it’s important to evaluate not just the initial premium, but also the total cost over time. Look at your annual premium costs and factor in deductibles, copayments, and coinsurance. By estimating the overall cost of a policy, you can make an informed decision about whether it’s sustainable for your family’s budget.

Additionally, keep in mind that premiums can increase over time, especially with health insurance. It’s important to plan for future price increases and assess whether the coverage you’re getting still justifies the cost.

9. Work with an Insurance Agent or Broker

If you find the process of comparing insurance policies overwhelming, consider working with an insurance agent or broker. These professionals can help you navigate the complex world of insurance and ensure that you’re getting the best deals for your family’s needs. They can also help you understand any gaps in coverage, potential savings, and policy options that may be available to you.

An agent or broker can save you time and effort while ensuring that you’re making well-informed decisions about your family’s insurance needs. Just be sure to choose a reputable professional who works with a variety of insurers to provide unbiased advice.

The Importance of an Emergency Fund Alongside Insurance

While having adequate insurance coverage is crucial for protecting your family against unexpected events, it’s also important to complement your policies with an emergency fund. An emergency fund acts as a financial cushion, providing a buffer when you face unexpected expenses that insurance may not cover, such as high deductibles or costs that fall outside of your insurance policies.

1. Why You Need an Emergency Fund

Emergencies, by their nature, are unpredictable. Whether it’s an unexpected car repair, a sudden illness that requires out-of-pocket medical costs, or urgent home repairs, life can throw curveballs. Insurance helps mitigate some of these costs, but it doesn’t cover everything. An emergency fund acts as your safety net, reducing the stress of dealing with unexpected financial setbacks.

The importance of an emergency fund becomes even clearer when you consider insurance deductibles. For example, after a car accident, your auto insurance may cover the repair costs, but you’ll likely need to pay the deductible first. Similarly, a hospital visit may be partially covered by your health insurance, but you’ll still have co-pays and other uncovered expenses. Having an emergency fund in place means you won’t have to go into debt to cover these costs.

2. How Much Should You Save?

Financial experts recommend saving at least three to six months’ worth of living expenses in an emergency fund. For a growing family, this amount may need to be on the higher end of the spectrum, as you’ll likely have increased responsibilities and expenses. For instance, if your monthly living expenses total $4,000, aim for an emergency fund of at least $12,000–$24,000.

If you’re just starting, don’t be discouraged if you can’t immediately reach this amount. Start small, aiming to save a little each month. Even having a few months’ worth of expenses saved up will give you peace of mind in case of an emergency.

3. The Role of Your Emergency Fund in Crisis Management

An emergency fund provides more than just financial protection. It offers a sense of control and stability during uncertain times. Imagine the peace of mind you would have knowing that if your car breaks down or your child needs urgent medical care, you don’t have to worry about finding money on short notice.

Without an emergency fund, you may be forced to rely on credit cards, loans, or other high-interest debt options, which can quickly spiral out of control. By proactively saving for emergencies, you avoid the financial stress that comes with borrowing money, and you ensure that your insurance works alongside your savings to provide comprehensive protection for your family.

4. When to Use Your Emergency Fund

An emergency fund is intended for true emergencies, not for planned expenses like vacations or home improvements. It’s important to differentiate between “emergencies” and “wants.” For example, if your family’s roof is leaking and needs repairs immediately, that’s an emergency. But if you want to upgrade your kitchen, that can wait until you’ve saved up the money or have budgeted for it.

Using your emergency fund wisely ensures that it’s available when you really need it. If you find yourself tapping into it for non-essential items, you’ll quickly deplete your savings, leaving you vulnerable when a real crisis occurs.

5. Building an Emergency Fund While Paying for Insurance

It can be challenging to build an emergency fund while paying for insurance premiums. However, by prioritizing savings and budgeting, it’s entirely possible. You can start by setting aside a small portion of your income each month. Even if it’s just $50–$100 per month initially, it will add up over time.

Consider automating your savings. Set up a separate savings account for your emergency fund and arrange for automatic transfers from your checking account. This ensures that you’re consistently putting money aside without the temptation to spend it elsewhere.

6. Using the Fund in Combination with Insurance

While insurance can cover large expenses like hospital bills or property damage, your emergency fund can cover things that insurance doesn’t, like high deductibles or items that fall outside your policy limits. For example, if you have health insurance with a high deductible, you may need to use your emergency fund to cover the out-of-pocket costs before your insurance kicks in.

Additionally, your emergency fund can cover any gaps in your insurance policies. Suppose your car is damaged in a storm, but the insurance policy only covers a portion of the damage. The rest of the cost can be covered using your emergency fund, preventing you from having to delay repairs or take out a loan.

7. Replenishing Your Emergency Fund After Use

If you use part of your emergency fund, it’s important to replenish it as soon as possible. Set a goal to rebuild your savings back to its original amount, so that you’re always prepared for the next unexpected event. This can be done gradually, but make it a priority to ensure you always have a financial cushion available.

Building and maintaining an emergency fund is a long-term commitment, but it’s one that pays off immensely in times of need.

8. The Peace of Mind That Comes with Having an Emergency Fund

Ultimately, the peace of mind that comes with knowing you’re prepared for emergencies can’t be overstated. Having a fully-funded emergency fund alongside your insurance gives you a robust safety net that protects your family financially and allows you to handle unexpected situations with confidence.

By managing both your insurance and savings effectively, you can provide your family with both security and financial stability, regardless of what life throws your way.

How to Choose the Right Insurer: Reputation and Reliability

Choosing the right insurer is just as important as choosing the right coverage. After all, an insurance policy is only as good as the company backing it. When selecting an insurer for your growing family, reputation and reliability should be at the top of your list of priorities. Here’s how to assess the reliability of an insurer before committing to a policy.

1. Research the Insurer’s Financial Stability

The financial health of an insurance company is one of the most important factors to consider when selecting a provider. You want to ensure that the company has the financial strength to pay claims, especially in the event of large-scale disasters or long-term claims.

You can check the financial stability of an insurance company by reviewing independent ratings from agencies such as A.M. Best, Fitch Ratings, and Moody’s. These agencies assess insurers based on their ability to meet ongoing financial obligations and pay out claims. Look for insurers with high ratings, as this indicates they are financially secure and able to handle potential claims.

2. Evaluate Customer Service and Claims Handling

Even the most financially stable insurers can fall short when it comes to customer service. The claims process is where an insurer’s reliability truly matters. A reputable insurer should have a track record of quickly and fairly processing claims. Look for reviews, testimonials, and ratings from other policyholders to gauge how well an insurer handles claims and customer support.

Before committing to a provider, take note of their response times, ease of communication, and the professionalism of their claims agents. Some insurers offer online claim filing, while others require more traditional methods. Choose a company that provides the most convenient and transparent claims process for you.

3. Look for Transparent Policies and Clear Terms

When choosing an insurer, ensure that they offer clear and transparent policies. A reputable insurer will be upfront about coverage details, exclusions, and limitations. Avoid companies that are vague or difficult to understand when it comes to explaining policy terms.

Read the fine print carefully and ask questions about anything you don’t understand. The more clarity you have regarding your policy, the less likely you are to face disputes or unpleasant surprises when you need to file a claim.

4. Check for Complaints and Compliment Reviews

An important step in evaluating an insurer is to look for complaints or issues raised by existing customers. Consumer protection websites such as Better Business Bureau (BBB) and Consumer Reports provide insight into how well an insurer is perceived in the market.

While no company is entirely free of complaints, be wary of insurers with consistent negative feedback, particularly regarding claims denial, poor customer service, or slow response times. On the flip side, insurers with a lot of positive reviews from customers indicate a more reliable company.

Navigating the Open Enrollment Period for Health Insurance

The open enrollment period for health insurance is a crucial time for securing coverage for your family. It’s the one time each year when you can sign up for or make changes to your health insurance plan without needing a special reason, like a life event. Here’s how to make the most of the open enrollment period to ensure you choose the best plan for your growing family.

1. Understanding Open Enrollment Dates

Each year, open enrollment for health insurance typically runs during a specific window of time, usually in the fall. The dates vary depending on whether you are purchasing insurance through your employer, the government marketplace (HealthCare.gov), or directly from an insurance company.

Mark these dates on your calendar so that you don’t miss the opportunity to enroll or make necessary changes to your coverage. Missing the deadline can leave you without coverage or with the same plan for another year, which may not be ideal as your family’s needs evolve.

2. Assessing Your Current Health Coverage

Before the open enrollment period begins, take time to assess your current health coverage. Review your current plan’s benefits, premiums, deductibles, and out-of-pocket costs. Consider whether your current plan is still meeting the needs of your growing family.

For example, if you’ve added a new child to the family or if you’ve had a change in your medical needs, you may find that your current plan no longer provides the most appropriate coverage. This is the perfect time to evaluate whether a different plan would better suit your needs.

3. Comparing Available Plans

During open enrollment, you’ll have the option to compare different health insurance plans. These may include employer-sponsored plans, government marketplace options, or individual plans from private insurers. When comparing plans, pay close attention to factors such as:

Premiums: The monthly cost you’ll pay for your health insurance.

Deductibles: The amount you must pay out-of-pocket before your insurance starts covering costs.

Out-of-pocket maximum: The total amount you’ll pay in a given year before the insurer covers all costs.

Coverage options: Look at what medical services are included, such as maternity care, pediatric services, dental and vision, and prescription drugs.

Choosing the right plan means striking a balance between affordable premiums and the coverage your family needs. Make sure that any essential healthcare services are included in the plan and that the network of doctors and hospitals aligns with your preferences.

4. Consider Your Family’s Healthcare Needs

As your family grows, so do your healthcare needs. You may need a plan that provides comprehensive maternity and newborn care if you’re expecting a baby. Alternatively, you might need pediatric care, mental health services, or coverage for chronic conditions.

Consider both the short-term and long-term healthcare needs of your family. For instance, if you have young children, you’ll want a plan that offers access to pediatricians, vaccines, and well-child visits. If anyone in the family has a chronic condition, such as asthma or diabetes, choose a plan that covers specialist care and medications at a reasonable cost.

5. Choosing Between HMO, PPO, and Other Plan Types

Health insurance plans come in various types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs), among others. Each type has its own advantages and limitations:

HMOs usually offer lower premiums but require you to see in-network doctors and get referrals from a primary care physician for specialists.

PPOs offer more flexibility in choosing healthcare providers and don’t require referrals, but premiums are typically higher.

EPOs offer lower premiums than PPOs but are more restrictive in terms of network options.

Consider which type best suits your family’s preferences for flexibility and care access.

6. Don’t Forget About Dental and Vision Coverage

When reviewing your health insurance options, don’t forget about dental and vision coverage. These are often separate plans or optional add-ons to major medical coverage, but they can be essential for a growing family, especially if you have young children who need routine check-ups and cleanings.

Some health plans include dental and vision coverage, but others do not. If they are not part of your primary health plan, consider adding them as standalone policies. Dental and vision care can add up quickly, so having insurance for these needs can save you money over time.

7. Subsidies and Financial Assistance

If you’re purchasing insurance through the government marketplace, you may be eligible for subsidies that help reduce the cost of premiums and out-of-pocket expenses. Eligibility for subsidies is typically based on your household income and family size.

If you’re eligible, these subsidies can make health insurance much more affordable. Be sure to check if you qualify before choosing a plan. Even if you don’t qualify for subsidies, the open enrollment period is an opportunity to explore all available options and find the best coverage at an affordable price.

8. Review Your Health Insurance Plan Yearly

Even if you’re satisfied with your current health insurance plan, it’s important to review it annually during open enrollment. Your family’s healthcare needs may change from year to year, and a plan that worked last year might not be the best option this year.

Changes in income, employment, or the health status of a family member may mean that another plan offers better coverage or more affordable premiums. Take the time to evaluate your current plan and make adjustments if necessary.

9. Mark Your Calendar and Set Reminders

To avoid missing the open enrollment window, set reminders and mark your calendar ahead of time. Open enrollment periods are fixed, and if you miss them, you may have to wait another year or face penalties. By staying proactive and organized, you’ll ensure that your family’s health insurance is up to date.

Reviewing Your Insurance Needs Annually

As your family grows and evolves, so do your insurance needs. Reviewing your insurance policies annually is essential to ensure that your coverage reflects the changes in your life. Whether it’s a new addition to the family, a new home, or changes in your health, regularly assessing your coverage helps you stay protected.

1. Changes in Family Size and Life Events

The most obvious reason to review your insurance is when significant life events occur. If you’ve had a new baby, adopted a child, or experienced a marriage or divorce, your family’s insurance needs may shift. You’ll likely need to update life insurance policies, health insurance coverage, and home insurance limits.

Life changes often affect other aspects of your insurance coverage as well. For example, if your children are growing up and starting to drive, you may need to adjust your auto insurance policy. Similarly, if you move to a larger home, your homeowner’s insurance policy may need to reflect the increased value of your property and possessions.

2. Changes in Income or Employment

A change in your employment status or household income can significantly impact your insurance needs. For instance, if your income has increased, you might want to review your life insurance to ensure your coverage is adequate. Alternatively, if you lose your job or switch employers, you may need to adjust your health insurance coverage, particularly if you are no longer eligible for an employer-sponsored plan.

A change in income may also affect your eligibility for certain types of insurance, such as subsidies for health insurance through the marketplace. Regularly reassessing your financial situation ensures that you’re not paying for more coverage than you need or missing out on necessary protection.

3. Adjusting Coverage as Your Needs Change

Your insurance coverage should evolve as your family’s needs change. For example, if your children are getting older and no longer need as many pediatric services, you might be able to switch to a health insurance plan with lower premiums and fewer child-specific services. On the other hand, if your children are becoming teenagers and starting to drive, you may need to add them to your auto insurance policy, which could increase your premium.

As your family’s assets and liabilities grow, such as purchasing a larger home or taking on a second car, it’s essential to adjust your homeowner’s and auto insurance policies. Reassessing your coverage ensures that you’re not over-insured or under-insured.

4. Evaluating the Cost of Your Premiums

Insurance premiums can fluctuate based on a variety of factors, such as changes in the insurance market, inflation, or adjustments to the coverage limits. Reviewing your premiums annually allows you to compare rates and determine whether you can find more affordable options. If your premiums have increased significantly, it may be time to shop around for new policies or providers.

However, remember that the cheapest policy isn’t always the best option. While cost is a major factor, quality of coverage and customer service should always be prioritized.

5. Assessing Your Risk Tolerance and Coverage Gaps

As your life changes, so does your risk tolerance. Perhaps your family is more financially stable now, and you’re comfortable with a higher deductible to save on premiums. Alternatively, you may want to increase your coverage limits if you feel that your family’s risks have increased (e.g., adding a teenager to your auto insurance policy).

Reviewing your policies allows you to identify any gaps in coverage. For example, you might discover that your homeowner’s insurance doesn’t cover a certain risk, like flooding, or that your health insurance doesn’t cover specific specialists or treatments you need. An annual review helps to ensure that you are adequately protected.

Considering Supplemental Insurance for Extra Protection

While comprehensive insurance coverage is crucial, sometimes it’s not enough to cover all potential needs. This is where supplemental insurance comes in. Supplemental insurance provides additional coverage to fill in the gaps left by your primary insurance, offering extra protection for your family.

1. What is Supplemental Insurance?

Supplemental insurance is designed to add extra layers of coverage on top of your existing insurance policies. It typically covers expenses that your primary insurance doesn’t fully pay for, such as copayments, deductibles, and uncovered medical procedures. Some common types of supplemental insurance include critical illness insurance, accident insurance, hospital indemnity insurance, and short-term disability insurance.

These policies are often affordable and can provide essential financial protection in situations where your regular insurance falls short. For example, if you experience a major illness that isn’t fully covered by your health plan, supplemental insurance can help with out-of-pocket costs, giving you more peace of mind.

2. Types of Supplemental Insurance

Several types of supplemental insurance can benefit your family depending on your specific needs:

Critical Illness Insurance: This type of policy provides a lump sum payment if you are diagnosed with a serious illness, such as cancer, heart attack, or stroke. The payout can help cover medical expenses, living costs, or any other expenses you may incur while recovering.

Accident Insurance: If someone in your family is injured due to an accident, accident insurance provides financial support to cover medical expenses and lost wages that aren’t covered by your primary health insurance.

Hospital Indemnity Insurance: This provides a daily benefit to help cover hospital expenses, such as room charges, which may not be fully covered by your health insurance. It can be especially useful for families with high hospitalization rates.

Short-Term Disability Insurance: This provides income replacement if you or your spouse are temporarily unable to work due to illness or injury. It helps bridge the gap until your primary disability coverage kicks in or until you recover.

Each of these policies serves a specific purpose, and choosing the right ones for your family depends on your unique needs, lifestyle, and health risks.

3. When to Consider Supplemental Insurance

Supplemental insurance becomes a good option when your primary insurance doesn’t provide full coverage. For example, many health insurance plans have high deductibles or large copayments, which may make it difficult for your family to afford medical bills after a hospital visit. Critical illness insurance can help cover these gaps by providing a cash payout that can be used for anything—whether it’s medical bills, childcare, or household expenses during a recovery period.

Another example is if you are at a higher risk of injury or illness. If someone in your family has a chronic condition or you have a high-risk occupation, supplemental insurance can provide extra protection in case of unexpected health events.

4. How to Choose the Right Supplemental Insurance

When considering supplemental insurance, evaluate your family’s specific needs. If you’re healthy and don’t expect to need frequent medical care, a basic hospital indemnity policy or accident insurance might be sufficient. However, if you or a family member has a history of serious medical conditions, critical illness insurance might provide more value.

It’s also important to consider the cost of these policies relative to the protection they offer. While supplemental insurance is generally affordable, the cost can add up if you purchase several policies. Carefully assess the risks you face and the likelihood of needing the coverage, and choose policies that provide the most relevant and necessary protection.

5. Review Your Primary Insurance Before Adding Supplemental Policies

Before purchasing supplemental insurance, review your primary insurance policies to ensure that you fully understand the coverage limits. For example, you might find that your health insurance already covers a substantial portion of hospitalization expenses, making hospital indemnity insurance unnecessary. By understanding the gaps in your current coverage, you can select the most appropriate supplemental insurance to fill those voids.

Also, check if any supplemental policies are already included in your current insurance plan. Some health insurance plans include accident insurance or limited coverage for critical illnesses, meaning you may not need to purchase additional coverage.

6. Cost vs. Benefit of Supplemental Insurance

While supplemental insurance is typically affordable, it’s important to weigh the cost of the policy against the potential benefits. For example, critical illness insurance can provide significant financial relief, but it may not be worth it if you’re young, healthy, and unlikely to need it. However, for older families or those with a history of serious illness, this type of insurance could provide essential support.

To determine if the cost is justified, consider how much coverage you actually need. Calculate the potential financial impact of various scenarios and see if the supplemental insurance will provide enough of a safety net. Remember, the goal is to create a comprehensive protection plan that balances cost with the necessary coverage.

7. The Convenience of Bundling Insurance

Some insurers offer discounts when you bundle supplemental insurance with your primary insurance policies. For instance, you might be able to get a discount on critical illness insurance or accident coverage when you purchase it through the same company that provides your health or life insurance. Bundling can save you money while ensuring that all of your policies are coordinated and easy to manage.

However, always compare the costs and coverage details across different providers before committing to bundled packages. While bundling may be convenient, it’s not always the cheapest option, so be sure to shop around for the best deal.

8. Check for Exclusions and Limitations

Before signing up for any supplemental insurance policy, carefully read the exclusions and limitations. Many supplemental policies have restrictions on what is covered and may not pay out under certain circumstances. For example, some critical illness policies only cover certain conditions, and accident insurance may have exclusions for specific types of injuries or activities.

Understanding these exclusions is crucial so that you don’t assume you’re covered for a situation when, in fact, you may not be. Make sure the policy aligns with your family’s needs and that it will provide the coverage you expect.

9. The Peace of Mind That Comes with Supplemental Coverage

Supplemental insurance can offer peace of mind by ensuring that you’re financially prepared for any situation. While your primary insurance covers most medical expenses, the added protection from supplemental insurance ensures that you won’t face unexpected out-of-pocket costs that could strain your finances. For growing families, this extra layer of coverage is particularly valuable in ensuring that your financial future remains secure in the face of unforeseen health issues.

How to Maximize Insurance Benefits for Your Family

Maximizing your insurance benefits isn’t just about having the right policies; it’s about using them effectively to get the most value for your family. By understanding your policies and knowing how to navigate them, you can ensure that your family receives all the coverage and support they are entitled to.

1. Understand Your Coverage

The first step to maximizing insurance benefits is understanding exactly what your policy covers. Whether it’s health, life, auto, or homeowners insurance, read through the details carefully. Pay special attention to the exclusions, the limits, and the types of care or services covered. Understanding the fine print helps you avoid surprises and makes it easier to take full advantage of the policy when you need it.

For example, with health insurance, many policies provide free preventive care, such as vaccinations and screenings. Make sure you take advantage of these benefits before you incur additional costs for medical services that could have been covered. Similarly, in auto insurance, some policies cover rental cars if your car is in the shop—make sure to know these details before you find yourself without transportation.

2. Review Your Plan Regularly

Your family’s needs can change quickly, and so can the benefits offered by your insurance plans. It’s important to review your insurance regularly—at least once a year, or after any major life events, like the birth of a child or buying a new house. During your review, check for any changes in coverage, premiums, or deductibles, and make adjustments if necessary.

If you notice that your premiums have increased or that certain coverages are no longer necessary, look into whether you can modify your policy or switch to a more affordable option. For example, as your children grow and their healthcare needs change, your health insurance plan may need to be adjusted.

3. Take Advantage of Preventive Services

Many insurance plans, especially health insurance, provide preventive services at no additional cost. These can include immunizations, routine screenings, and wellness exams. Be sure to schedule these preventive visits regularly, as they can catch potential health issues before they become more serious and expensive to treat.

Additionally, some life insurance policies offer living benefits that allow you to access a portion of the death benefit while still alive in case of a terminal illness. It’s important to check if your policy includes these features, as they can provide extra financial support during difficult times.

4. Use Network Providers

Insurance companies often negotiate lower rates with specific healthcare providers, car repair shops, or contractors, depending on the type of insurance. By using network providers, you can reduce out-of-pocket expenses and maximize your benefits. For health insurance, this might mean choosing doctors, hospitals, and specialists that are in-network for your plan.

While it may seem tempting to go out-of-network for the best care or the cheapest option, doing so can result in higher deductibles, co-pays, and surprise charges. Always check whether your preferred service providers are included in your insurance plan’s network before scheduling services.

5. Keep Detailed Records

Keeping detailed records of your insurance claims, medical bills, and any services you’ve received is critical to maximizing your benefits. If you ever need to appeal a claim or resolve an issue, having a comprehensive record will make the process easier and more efficient.

For health insurance, keep receipts, explanations of benefits (EOBs), and any communication from your insurer. For auto or home insurance, retain photos, repair bills, and estimates for claims related to accidents or property damage.

6. Check for Additional Coverage Options