Life insurance is one of the most important financial products you can invest in, providing financial protection for your loved ones in the event of your death. But understanding the different types of life insurance specifically Term Life vs Whole Life Insurance can be overwhelming. Each has its own unique features, benefits, and drawbacks, making it essential to choose the right one based on your needs and goals.

Life insurance is not a one-size-fits-all solution. The main purpose of life insurance is to provide a financial safety net for your beneficiaries, ensuring they can cover living expenses, debts, and any unforeseen costs that arise after your passing. However, the way life insurance works, how much it costs, and what it covers can vary significantly depending on whether you choose term or whole life insurance.

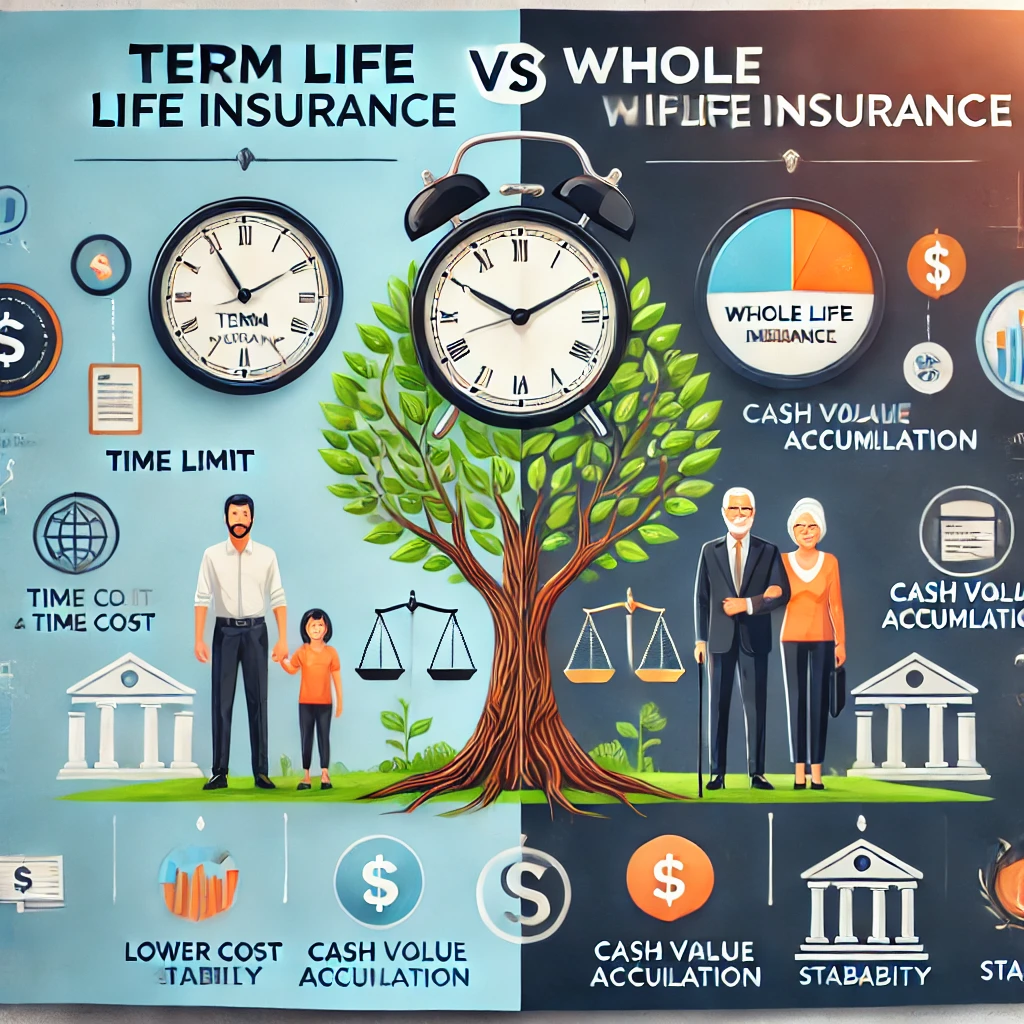

Term life insurance is often seen as a more straightforward option, with a fixed coverage period (the term) and generally lower premiums. On the other hand, whole life insurance provides lifelong coverage, accumulating cash value over time, but typically comes with higher premiums. The decision between term and whole life depends on factors such as your age, health, financial situation, and long-term goals.

In this guide, we’ll break down both types of life insurance, explain their key differences, and offer insights into which option might be best for you. By the end, you’ll have a clearer understanding of the two insurance types and the factors to consider when making your decision. So let’s dive right in!

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period—usually 10, 20, or 30 years. It’s called “term” life insurance because the coverage only lasts for a predetermined “term” or length of time. If you pass away during the policy term, your beneficiaries receive the death benefit. However, if you outlive the term of the policy, there is no payout, and the coverage ends unless you decide to renew or convert the policy.

One of the main benefits of term life insurance is its affordability. Since it only provides coverage for a set period and doesn’t build cash value, it tends to have much lower premiums than whole life insurance. This makes it an attractive option for people who need substantial coverage for a limited time, such as parents of young children or people with a mortgage.

Term life insurance is often seen as a pure protection product, offering financial security in case of unexpected death. Because of the lower cost, policyholders can purchase a higher level of coverage compared to whole life insurance. This makes term life insurance ideal for people with temporary financial obligations, such as paying off a mortgage or covering college expenses for children.

However, one drawback of term life insurance is that once the term expires, you no longer have coverage, and there’s no cash value accumulated. You also face the risk of having to renew your policy at higher rates if you’re older or have developed health issues. Some term policies offer a “renewable” option, which allows you to extend coverage, but premiums will usually increase significantly after the initial term ends.

Another feature of some term life policies is the ability to convert them to permanent insurance, such as whole life insurance, before the term expires. This can be useful if your health has changed and you want to ensure lifelong coverage. Conversion options can vary depending on the insurance company and the specific terms of the policy.

Because term life insurance is straightforward and cost-effective, it is often recommended for people in their prime earning years or those who want to cover specific temporary financial obligations. However, it may not be suitable for people seeking permanent, lifelong coverage or those interested in building cash value.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue paying the premiums. Unlike term life insurance, whole life insurance doesn’t expire after a set number of years; it covers you until your death, regardless of when that occurs. This provides your beneficiaries with a guaranteed death benefit whenever you pass away.

One of the key features of whole life insurance is its ability to accumulate cash value over time. This cash value grows at a guaranteed rate, which you can borrow against or use to pay your premiums. As the cash value accumulates, it becomes a living benefit that you can access while you’re still alive. This makes whole life insurance a combination of insurance protection and an investment vehicle.

Because of the lifelong coverage and cash value component, whole life insurance tends to be more expensive than term life insurance. The premiums are typically much higher, and they remain level throughout the life of the policy. This means that as you age, your premiums won’t increase, unlike term life insurance where premiums often rise with age.

Whole life insurance can be an attractive option for people who want to ensure financial protection for their loved ones no matter when they pass away. It also serves as a useful tool for estate planning, as the death benefit is often tax-free to beneficiaries. The cash value growth can be an additional benefit, allowing policyholders to build wealth over time while maintaining coverage.

However, the higher premiums can be a downside for some. The initial cost may be prohibitive, especially for younger individuals or families with limited budgets. Additionally, the cash value growth is generally slow in the early years, meaning the policy may not provide a significant return on investment right away. Still, over time, the policy can become a valuable asset if managed properly.

For those who have long-term financial goals or want to leave a legacy, whole life insurance may be a good fit. It is particularly beneficial for individuals who have complex estate planning needs or who are seeking stability and predictability in their financial planning.

Key Differences Between Term and Whole Life Insurance

When comparing term life insurance and whole life insurance, it’s important to understand the key differences that will influence your decision. While both types of life insurance provide a death benefit, the way they function, their costs, and their long-term benefits differ considerably.

Coverage Duration: The most obvious difference between the two is the duration of coverage. Term life insurance is temporary, providing coverage for a specific term (e.g., 10, 20, or 30 years). Whole life insurance, on the other hand, is permanent and covers you for your entire life, as long as premiums are paid.

Premiums: Term life insurance typically has much lower premiums compared to whole life insurance. Since term life only covers a limited period and doesn’t accumulate any cash value, the cost is generally more affordable. Whole life insurance premiums are higher because they provide lifelong coverage and also include a cash value component.

Cash Value: A major distinguishing feature of whole life insurance is the cash value component. As you pay premiums, a portion of the money goes toward building cash value, which grows over time. You can borrow against this cash value or use it to pay premiums. Term life insurance, however, does not accumulate any cash value. Once the term expires, you have no asset to draw upon.

Flexibility: Term life insurance is relatively inflexible because it provides coverage only for a set period and doesn’t have an investment component. Whole life insurance offers more flexibility in terms of cash value accumulation, policy loans, and even the ability to adjust premiums (in some cases). Whole life policies can also be adjusted to some extent through riders, while term policies typically cannot.

Death Benefit: Both term and whole life insurance provide a death benefit, but the benefit structure is different. Term life provides a fixed death benefit for the term of the policy, whereas whole life guarantees a death benefit regardless of when you pass away. Additionally, with whole life, the death benefit is generally accompanied by the accumulated cash value, which can enhance the overall payout.

Cost Efficiency: In the short term, term life insurance is more cost-effective. You pay lower premiums for a set coverage period, which allows you to get more coverage for less money. Whole life insurance, while more expensive in the short term, can provide long-term value due to the cash value accumulation and lifelong coverage.

Risk vs. Security: Term life insurance is typically considered a more “risky” choice, as the policy ends after the term and there is no accumulation of wealth. Whole life insurance is seen as more “secure” because it offers guaranteed coverage for life, along with the potential for cash value growth.

Investment Aspect: Whole life insurance serves as both a life insurance policy and an investment, providing policyholders with an opportunity to accumulate cash value. Term life insurance, however, is purely protection-based, with no investment component.

Simplicity vs. Complexity: Term life insurance is relatively simple and straightforward, which makes it easy to understand and manage. Whole life insurance, due to its lifelong coverage and cash value accumulation, can be more complex and requires more understanding and attention.

Cost Comparison: Term Life vs Whole Life

When it comes to cost, term life insurance is generally the more affordable option for most people. The reason for this is simple: term life only provides coverage for a limited time, typically 10, 20, or 30 years. Since the insurance company only has to pay out if you die during the term, the premiums are lower. Moreover, because term policies don’t accumulate cash value, the insurer doesn’t need to invest your premiums for future growth, further lowering the cost.

The premiums for whole life insurance, on the other hand, are significantly higher. This is because whole life insurance provides lifelong coverage, which means the insurer takes on more risk. Additionally, whole life policies accumulate cash value, which requires the insurer to set aside part of the premiums to fund this. As a result, whole life insurance tends to be more expensive than term life insurance for the same amount of coverage.

The cost of whole life insurance is often a point of contention for many people considering this type of policy. The premiums tend to remain the same throughout the life of the policy, but they can be five to ten times higher than term life premiums, depending on your age, health, and the size of the death benefit.

One factor that can influence the cost of both types of insurance is your age. The older you are when you purchase a policy, the more expensive your premiums will likely be. However, the price increase is typically much more noticeable with whole life insurance because the coverage is permanent. With term life insurance, the increase in cost may be more gradual, especially if you choose to renew the policy after the initial term ends.

Another key consideration in cost is the death benefit. With both term and whole life insurance, the death benefit is typically chosen at the time of purchase. The larger the death benefit, the higher the premiums will be. With term life insurance, you may be able to purchase a larger death benefit for a lower premium, while with whole life insurance, the higher premiums may limit the amount of coverage you can afford.

Finally, there is the cash value component to consider with whole life insurance. While you may pay higher premiums, the cash value that builds up over time can be accessed or used to offset premium payments in the future. For some policyholders, this provides a significant benefit, as it creates an asset that can be used during their lifetime. However, it’s important to keep in mind that the cash value growth is usually slow in the early years of the policy.

Pros and Cons of Term Life Insurance

Term life insurance offers several advantages, but it also comes with limitations. Let’s break down the pros and cons to give you a clearer idea of how it fits into different financial planning strategies.

Pros:

Affordability: Term life insurance is usually much cheaper than whole life insurance. The lower premiums make it a more attractive option for people on a budget or those who need temporary coverage for specific financial responsibilities, like paying off a mortgage or covering a child’s education.

Simplicity: The structure of term life insurance is straightforward, making it easy to understand. You pay premiums for a set period, and if you die within that period, your beneficiaries receive the death benefit. There are no confusing clauses or hidden fees.

High Coverage Amounts: Since term life insurance is more affordable, you can typically purchase a higher amount of coverage for the same premium as a whole life policy. This is especially important if you have dependents or significant financial obligations, like a mortgage or personal loans.

Flexibility in Term Length: Term life policies come in various term lengths, typically 10, 20, or 30 years. You can choose the length based on your current needs—whether you’re looking to cover a few years of high expenses or provide long-term protection for a young family.

Convertible Options: Some term life policies offer the option to convert to permanent life insurance (like whole life) before the term expires. This gives you flexibility if your needs change and you decide you want lifelong coverage.

No Cash Value: While this might seem like a disadvantage, the lack of a cash value component keeps premiums lower. If you’re only looking for insurance protection without the need for an investment feature, term life may be ideal.

Clear Objective: Term life insurance is designed with a specific purpose in mind: providing coverage for a limited period. It’s perfect for those who want to ensure their loved ones are financially secure during a defined period, such as until their children graduate or a mortgage is paid off.

No Unnecessary Complications: Term life is easy to manage because there’s no investment element or accumulated cash value. It’s ideal for those who just need a simple life insurance policy without worrying about how the policy’s investments are performing.

Policy Renewability: Although your premiums may increase after a term ends, many term life policies offer renewal options. This is beneficial if your health declines over time, as you won’t need to undergo another medical exam to continue coverage.

Cons:

No Lifelong Coverage: Once the term ends, so does your coverage. This can be a significant downside if your health deteriorates over time or if you outlive the term but still need insurance coverage. Renewing after the term ends can result in significantly higher premiums.

No Cash Value: Since term life insurance doesn’t accumulate cash value, there’s no “investment” aspect. This means you can’t borrow against the policy or use the accumulated value to offset future premiums.

Potential for Increased Premiums: If you decide to renew your policy after the initial term, your premiums will likely be much higher due to your age. As you age, insurance companies see you as a higher risk, which drives up the cost.

Limited Duration: If you outlive the term and still need coverage, you may have to purchase a new policy at a higher cost. Alternatively, you might be left without coverage when you need it most.

Rising Premiums with Age: Many term life policies have a fixed premium during the initial term, but once the term expires, the cost to renew can rise sharply. This can be financially challenging, especially for those on a fixed income in retirement.

Term life insurance is a solid choice for people who want affordable coverage for a set period and have a clear financial goal in mind, such as paying off debts or providing for children until they become financially independent. However, the lack of lifetime coverage or cash value means it’s not suited for everyone.

Pros and Cons of Whole Life Insurance

Whole life insurance provides lifelong coverage and includes a cash value component, but it comes with its own set of advantages and challenges. Below, we’ll break down the pros and cons of whole life insurance.

Pros:

Lifelong Coverage: Unlike term life, which expires after a set period, whole life insurance covers you for your entire life, as long as you continue paying premiums. This guarantees that your beneficiaries will receive a death benefit, no matter when you pass away.

Cash Value Accumulation: Whole life insurance builds cash value over time, which grows at a guaranteed rate. This cash value can be borrowed against, withdrawn, or even used to pay premiums, providing more flexibility than term life insurance.

Guaranteed Death Benefit: Whole life insurance offers a guaranteed death benefit. This peace of mind can be particularly valuable for estate planning or ensuring that your loved ones are financially protected.

Level Premiums: The premiums for whole life insurance remain level throughout the life of the policy, meaning they won’t increase as you age. This can be an advantage if you’re looking for predictable costs over time.

Tax Advantages: The cash value growth in a whole life policy is tax-deferred, meaning you won’t owe taxes on the gains until you withdraw them. Additionally, the death benefit is typically paid out tax-free to beneficiaries.

Financial Security: Whole life insurance provides long-term financial security. It can be a tool for estate planning, ensuring that wealth is passed down to heirs, and can be used as a strategy for leaving a legacy.

No Need for Renewal: Unlike term life insurance, there’s no need to worry about renewing your policy. Once you have whole life insurance, you’re covered for life, eliminating the uncertainty of whether your insurance will continue.

Potential to Borrow Against the Policy: The cash value accumulated in the policy allows you to borrow funds against it at relatively low interest rates. You can use these funds for emergencies, education, or to supplement retirement income.

Peace of Mind: Whole life insurance offers the ultimate peace of mind, knowing that your family will be financially taken care of, no matter when you pass. The lifelong coverage, coupled with the cash value, provides a long-term safety net.

Cons:

High Premiums: The biggest downside to whole life insurance is its high premiums. The cost of premiums can be five to ten times higher than term life insurance for the same amount of coverage, making it unaffordable for some people, especially those with limited income.

Slow Cash Value Growth: Although whole life policies accumulate cash value, the growth is often slow in the early years of the policy. You may not see significant returns in the first few years, which can be frustrating if you’re hoping for quicker results.

Complexity: Whole life insurance can be more complex than term life insurance. Understanding how the cash value works, the interest rates, and how dividends are distributed requires more time and attention than a simple term life policy.

Potentially Expensive in Later Years: While premiums remain fixed throughout the life of the policy, they can be high in your younger years, and they don’t typically decrease as you age. Over time, the cumulative premiums paid into the policy could far exceed the death benefit.

Limited Investment Options: The growth of the cash value is tied to the insurer’s investment strategies, which may not yield high returns. Unlike other investment vehicles (stocks, bonds, etc.), you’re limited to what the insurer can provide, which may not align with your financial goals.

Lower Initial Benefit: Whole life insurance is designed to build cash value, but the amount of insurance coverage you receive initially may be lower compared to a similar term life policy, since some of your premiums are allocated to the cash value.

Inflexible Payments: Although some whole life policies offer flexibility in premium payments, most require regular, fixed payments. This can be a financial strain, especially during tough economic times or periods of financial uncertainty.

Opportunity Cost: Because of the higher premiums, you might have to sacrifice other financial goals (like saving for retirement or buying a home). Whole life insurance is a long-term commitment, and the funds allocated to premiums could potentially be better invested elsewhere.

Surrender Charges: If you decide to cancel your whole life policy early, you may face surrender charges, which can reduce the amount of cash value you receive. This could make it difficult to recover the cost of the policy if you no longer need it.

While whole life insurance provides long-term benefits, the high premiums and complexity can make it an unsuitable choice for people with simpler needs. It’s ideal for those looking for permanent coverage and who want to integrate life insurance into their long-term financial planning strategy.

Which is Better for You? Term or Whole Life Insurance?

When deciding between term life insurance and whole life insurance, the right choice largely depends on your personal situation, financial goals, and long-term needs. Both policies serve different purposes, and understanding those differences can help you make a more informed decision.

Choose Term Life Insurance If:

You need temporary coverage for a specific time period (e.g., to cover the duration of a mortgage or until children are financially independent).

You’re on a budget and looking for an affordable way to secure a large death benefit.

You don’t want the investment component that comes with whole life insurance and are simply looking for pure protection.

You’re in good health and want to take advantage of lower premiums in the early years.

You plan to reassess your needs when the term ends and might decide to purchase a new policy or no longer need life insurance.

Choose Whole Life Insurance If:

You’re looking for lifetime coverage and want to ensure your beneficiaries receive a death benefit regardless of when you pass away.

You want to build cash value over time, which you can borrow against or use for other financial needs.

You have long-term estate planning goals and want to provide for heirs or create a legacy.

You are interested in having a more predictable and stable premium structure throughout your life.

You want to integrate life insurance into a broader wealth-building strategy, such as using it as collateral for loans or adding it to your overall retirement planning.

Ultimately, the decision comes down to what’s most important to you—whether it’s cost savings in the short term or long-term benefits and security. Many people also combine both types of life insurance as part of a broader strategy. For example, a term life policy might cover temporary financial obligations, while whole life insurance provides a permanent financial safety net.

How Long Does Term Life Insurance Last?

The duration of term life insurance depends on the term length you select when you first purchase the policy. Term lengths commonly range from 10 to 30 years, but some insurers may offer terms as short as 5 years or as long as 40 years. The coverage lasts for the entire duration of the term, but if you outlive the term, the policy expires and you no longer have coverage unless you choose to renew it.

For example, if you purchase a 20-year term life insurance policy when you’re 30, your policy will expire when you turn 50. If you pass away during the 20-year period, your beneficiaries will receive the death benefit. If you survive past the 20 years, the policy ends, and there is no payout.

Renewing Term Life Insurance: Many term policies offer a renewal option at the end of the term, although this typically comes with a higher premium since your age and health may have changed. Some policies allow you to convert the term policy into a permanent policy (such as whole life), which can help you avoid having to undergo another medical exam.

The duration of your term life insurance should be chosen based on your current financial needs. If you’re looking to cover a mortgage or have children that will need financial support until they reach adulthood, you’ll likely want a term that aligns with those milestones.

Whole Life Insurance: Lifetime Coverage and Beyond

Whole life insurance is often touted as the ultimate form of life insurance due to its lifetime coverage and the added benefit of cash value accumulation. As the name suggests, it’s designed to cover you for your entire life, provided you continue paying premiums. This guarantees that your beneficiaries will receive a death benefit, no matter when you pass away.

Permanent Coverage: The most obvious benefit of whole life insurance is that it provides coverage for your entire life, as long as premiums are paid. This gives you peace of mind knowing that no matter how old you get, your loved ones will receive a death benefit when you pass away. Unlike term life insurance, which expires after a set period, whole life insurance guarantees coverage for your entire life, without the need for renewal.

Cash Value Accumulation: In addition to providing a death benefit, whole life insurance has a unique feature—cash value. A portion of your premiums is set aside in a savings account that grows over time. This cash value accumulates on a tax-deferred basis, meaning you don’t pay taxes on it until you withdraw the funds. This aspect can be a powerful tool for building wealth over time. The cash value grows at a guaranteed rate, which provides stability and security, though it’s often slower in the early years of the policy.

Loans and Withdrawals: The cash value that accumulates in your whole life policy can be accessed during your lifetime. You can borrow against it or make withdrawals, which gives you financial flexibility. Loans taken from the cash value are typically at low interest rates, and the loan amount doesn’t need to be repaid during your lifetime. However, any unpaid loan balances (plus interest) will be deducted from the death benefit when you pass away.

Dividends: Some whole life policies are “participating” policies, meaning they can pay dividends to policyholders. These dividends are not guaranteed, but when they are paid, they can be used in several ways: they can be taken as cash, used to reduce premiums, or reinvested into the policy to increase the death benefit and cash value. Participating whole life policies offer a unique advantage for policyholders seeking a potential source of passive income or additional benefits.

Predictable Premiums: The premiums for whole life insurance remain the same throughout the life of the policy. This is particularly advantageous for people who want stable, predictable costs over time. While the initial premiums may be high compared to term life, they don’t increase as you age, making it easier to plan for future financial needs. This stability in premiums is an attractive feature for those who prefer a more structured and dependable financial product.

Estate Planning: Whole life insurance is often used in estate planning. Since it offers lifelong coverage and builds cash value, it can be an important part of a comprehensive estate strategy. The death benefit is typically paid out tax-free, which means your beneficiaries won’t have to pay taxes on the inheritance they receive. This can help preserve wealth for your heirs and can be used to cover estate taxes, which may be significant for individuals with large estates.

Financial Security and Peace of Mind: For many people, the main benefit of whole life insurance is the peace of mind it provides. Knowing that your family will always be financially protected, regardless of when you pass away, gives people a sense of security. Whole life insurance can be a key component of long-term financial security, particularly for individuals who want to ensure their beneficiaries are financially supported for generations to come.

Drawbacks of Whole Life Insurance: While whole life insurance has many benefits, it’s not without its drawbacks. The most significant downside is the high cost. The premiums for whole life policies can be five to ten times more expensive than term life policies for the same amount of coverage. This can make it unaffordable for some people, especially if you’re just starting out in your financial journey or have limited income. Additionally, the cash value growth can be slow in the early years of the policy, meaning you may not see significant returns immediately.

Long-Term Commitment: Whole life insurance is a long-term commitment. It’s not designed to be something you buy and then cancel after a few years. The benefits and cash value grow over time, but to fully realize the potential, you’ll need to keep the policy for decades. If you cancel your policy early, you may face surrender charges, and you might not have accumulated enough cash value to make the policy worthwhile.

Should You Choose Whole Life Insurance?: Whole life insurance is ideal for people who want lifelong coverage, are interested in building cash value over time, and are willing to commit to higher premiums for long-term security. It’s particularly beneficial for individuals who are looking to leave a legacy or have complex estate planning needs. However, it may not be the best choice for people who only need temporary coverage or are looking for an affordable solution.

Understanding the Cash Value of Whole Life Insurance

One of the most distinctive features of whole life insurance is its cash value component, which sets it apart from term life insurance. This cash value grows over time and can be accessed by policyholders, providing an additional layer of flexibility and financial benefit. But how does this cash value work, and what should you know about it?

What is Cash Value?: The cash value of a whole life policy is essentially the savings portion of the policy. When you pay your premiums, part of the money goes toward the death benefit, and part goes into the cash value account. Over time, the cash value grows, often at a fixed interest rate determined by the insurer. This is a long-term accumulation of wealth that can be accessed in various ways.

Growth of Cash Value: Cash value grows slowly in the early years of a whole life policy, but it accelerates over time. The growth is typically guaranteed at a set rate, which means that no matter what happens in the market or to the insurer’s investments, your cash value will grow at least at this guaranteed rate. Some policies also pay dividends, which can further increase the cash value if you choose to reinvest them. However, it’s important to note that the dividends are not guaranteed.

Using Cash Value: The cash value in a whole life policy can be accessed in two main ways: through loans or withdrawals. If you need liquidity, you can borrow against the cash value of the policy, using it as collateral. The interest rates for loans are typically lower than those of personal loans or credit cards, and you don’t need to repay the loan in your lifetime (though unpaid loans will be deducted from your death benefit).

Withdrawals and Surrendering Cash Value: Instead of taking a loan, you can also choose to make a withdrawal of your cash value. However, withdrawing cash value reduces the death benefit, and if you withdraw too much, it could affect the policy’s ability to provide sufficient coverage. Alternatively, if you decide you no longer need the policy, you can surrender it and receive the cash value (minus any applicable surrender fees).

Cash Value vs. Death Benefit: It’s important to understand that while the cash value grows, it doesn’t replace the death benefit. The death benefit is the amount your beneficiaries receive upon your death, whereas the cash value is an amount you can access while alive. In some cases, a portion of the death benefit may be used to pay the premiums or cover loan balances.

Cost of Cash Value Accumulation: One thing to keep in mind is that the accumulation of cash value comes at a cost. Whole life insurance policies are more expensive than term life policies because part of the premium is allocated toward building the cash value. If you’re primarily interested in life insurance for the death benefit, the higher premiums may not feel justified, as the cash value may take years to accumulate meaningful amounts.

Impact of Early Withdrawal: Taking out funds from your cash value early on could diminish the financial benefits of the policy. Some policies also impose fees if you cancel your coverage within the first few years, so withdrawing or surrendering the cash value may come with financial penalties that reduce the policy’s worth.

Building Wealth for Future Generations: In the long run, whole life insurance’s cash value can serve as a tool for wealth transfer. The cash value growth, plus the guaranteed death benefit, creates a comprehensive financial strategy for passing assets to the next generation. Over time, the policy can become a powerful estate planning tool, especially if you choose a policy that is designed for high cash value growth.

Long-Term Commitment: The key takeaway about cash value is that it’s a long-term benefit. Whole life insurance is a product for people who plan on keeping the policy in place for decades, ensuring that their family is protected while simultaneously accumulating a growing cash value. If you’re unsure about long-term financial commitments or prefer more immediate financial gains, a whole life policy’s cash value may not be the right choice.

The Investment Element in Whole Life Insurance

While whole life insurance is primarily a life insurance product, it also acts as a type of investment. The way it integrates investment features is what sets it apart from other life insurance policies, like term life. Understanding the investment component is essential for those who are considering whole life insurance as a way to grow wealth.

How the Investment Works: The investment element of whole life insurance revolves around the cash value component. As mentioned earlier, part of your premium goes toward the death benefit, while the other part is used to accumulate cash value. This cash value grows at a fixed, guaranteed rate and may also earn dividends, depending on the policy. The dividends can be reinvested to increase the policy’s cash value or used in other ways, such as reducing premiums or purchasing additional coverage.

Guaranteed Growth: One of the main selling points of whole life insurance as an investment is its guaranteed growth. While the return on investment (ROI) might not be as high as other market-based investments, the cash value in a whole life policy will grow at a fixed rate determined by the insurer, regardless of market conditions. This makes it a more secure and stable investment, particularly for conservative investors who prioritize security over high returns.

Dividends as a Bonus: Many whole life policies are “participating” policies, which means that policyholders may receive dividends. These dividends are paid out by the insurer when the company performs well, and the amount varies from year to year. Though dividends are not guaranteed, they offer policyholders a chance to earn additional benefits. These dividends can be reinvested into the policy, adding to the cash value or increasing the death benefit, which enhances the overall financial value of the policy.

Returns vs. Other Investment Vehicles: While whole life insurance is an attractive option for certain types of investors, its returns are often lower than those of other investment vehicles, like stocks, bonds, or mutual funds. The investment component of whole life insurance is not designed for people who are looking for significant capital appreciation. Instead, it’s better suited for those who value the stability and predictability of returns, along with the guaranteed death benefit.

The Cost of the Investment: The higher premiums of whole life insurance are essentially the cost of the investment aspect. For some individuals, the added cost of the insurance policy might not justify the returns. If your goal is to maximize your investment returns, you may be better off considering other types of financial products, such as individual retirement accounts (IRAs), stocks, or mutual funds, which offer greater potential for growth.

Investment vs. Insurance: Whole life insurance is a hybrid product—it’s both an insurance policy and an investment vehicle. For those primarily concerned with life insurance, the investment component may feel like an extra, though it can certainly help to build wealth in the long term. For individuals interested in using life insurance as a financial tool to both protect their family and build wealth, the investment aspect can provide a helpful safety net.

Using Whole Life for Financial Planning: Some people use whole life insurance as part of their overall financial planning strategy. Because the cash value grows at a fixed rate, it can serve as a conservative asset in a diversified portfolio. While it may not generate explosive returns like stocks, the guaranteed growth can provide a stable foundation in your financial strategy.

Long-Term Benefits: Whole life insurance can be viewed as a long-term investment that builds over time. It’s a slow, steady accumulation of wealth that grows alongside the death benefit, creating a comprehensive financial tool that helps protect loved ones while growing value. Over the long term, policyholders may find that their whole life policy becomes a solid asset in their portfolio.

Should You Invest in Whole Life Insurance?: Whole life insurance might not be for everyone, especially if you’re focused on aggressive investment strategies or short-term financial goals. However, if you’re looking for financial security, lifelong coverage, and a guaranteed return, whole life insurance can be a valuable investment tool. It’s best for people who want a steady, predictable return with a side benefit of insurance coverage.

The Flexibility of Term Life Insurance

When considering life insurance, one of the most attractive features of term life insurance is its flexibility. Unlike whole life insurance, which is designed for the long term, term life policies provide protection for a fixed period. This flexibility makes term life an appealing option for many individuals, depending on their financial needs.

Short-Term Coverage: Term life insurance is ideal for those who need temporary coverage for specific financial obligations. Whether it’s paying off a mortgage, covering education costs for children, or ensuring a business loan is paid, term life provides coverage for the exact period you need it. Once the term expires, you no longer need to worry about premiums unless you choose to renew or convert your policy.

Affordable and Adjustable: The cost of term life insurance is another reason for its flexibility. It’s much more affordable than whole life insurance, and it allows you to select the amount of coverage that fits your budget. You can purchase a higher death benefit for a lower premium, making term life insurance especially attractive to families or individuals with tight budgets.

Convertibility Options: Some term life policies offer conversion options, which means you can switch to a whole life or another form of permanent insurance policy without needing to reapply or undergo a medical exam. This is useful if you start with term life insurance but later realize that you want permanent coverage.

Flexible Term Lengths: Term life policies come in a variety of lengths—typically 10, 20, or 30 years—but you can often tailor the length of coverage to your specific needs. This flexibility allows you to align your coverage with major life events, like a child’s college graduation or the completion of a mortgage.

Changing Coverage Needs: Life changes, and so do your insurance needs. Term life insurance gives you the flexibility to reassess your coverage every few years. If your financial situation changes, you can adjust the death benefit or purchase a new policy to match your current needs. This adaptability is a major selling point for people who anticipate changes in their life over time.

Simple to Understand: Another aspect of term life insurance that adds to its flexibility is its simplicity. Unlike whole life insurance, which has a variety of components (cash value, death benefit, etc.), term life is straightforward. You choose the coverage amount, the length of the term, and the premium, making it an easy policy to manage.

No Cash Value: A key point of flexibility is also a limitation: term life insurance doesn’t build any cash value. While this may seem like a disadvantage compared to whole life insurance, it also means that you’re only paying for the protection you need without additional costs for things like cash value accumulation or dividends. For many people, this simplicity and affordability are exactly what they need.

Renewal and Conversion: Many term life policies have the option for renewal at the end of the term, which means that you can continue your coverage, though it may come at a higher premium. If your health changes, you may not be able to secure a new policy at the same affordable rate, which is why some people choose to convert their term life policy to a permanent one before the term expires.

Ideal for Temporary Coverage: Term life is best suited for those who only need life insurance for a certain period, such as young families, people with dependents, or individuals with large debts. It provides affordable protection during those high-need years without the commitment of lifelong premiums.

Can You Convert Term Life Insurance to Whole Life?

One of the unique features of many term life insurance policies is the ability to convert your term policy into a permanent one, such as whole life insurance. This conversion option offers a significant degree of flexibility, especially if your needs change over time and you decide that you want lifelong coverage rather than temporary protection. But how does it work, and what should you consider before making the switch?

Conversion Option Explained: Conversion refers to the ability to convert your existing term life policy into a whole life or other permanent insurance policy without needing to undergo a medical exam. This means that even if your health has changed since you purchased the policy, you won’t be penalized with higher premiums or be denied coverage based on pre-existing health conditions.

When is Conversion a Good Idea?: There are several scenarios where converting your term policy to whole life insurance might make sense:

Health Decline: If your health has deteriorated during the term of your policy, converting to a permanent policy can ensure that you still have coverage for life, even if you wouldn’t qualify for new coverage due to health issues.

Changed Financial Goals: Over time, your financial goals may change, and you may decide that lifelong coverage and cash value accumulation are beneficial to your estate planning or wealth-building strategy.

Increased Dependents or Obligations: If you initially purchased term life to cover specific temporary financial obligations but later realized that you still have financial dependents or other long-term needs, converting to whole life could provide the permanent protection you need.

How Conversion Works: The process of converting a term policy into a permanent one typically involves selecting the type of permanent insurance you wish to convert to, such as whole life or universal life insurance. Most insurers allow this conversion without a medical exam, though there may be age limits or restrictions on the number of years you can wait before converting.

Cost of Conversion: The cost of converting your policy will vary depending on the amount of coverage, your age at the time of conversion, and the insurer’s rates. The premiums for whole life insurance are generally higher than those for term life, so once you convert, your premiums will likely increase. However, this increase might be less significant than if you applied for a new whole life policy based on your current health.

Conversion Period: The option to convert is usually available for a certain period during the term of your policy. For example, many policies offer a conversion option for the first 10-20 years of the term. After that, the option to convert may expire, so it’s important to keep track of this window if you’re considering conversion.

Advantages of Conversion: The primary advantage of converting a term policy to whole life is the guaranteed coverage regardless of changes in your health. It also eliminates the need to reapply for life insurance, which can be difficult if you’ve developed medical issues. Additionally, by converting early, you lock in the future ability to accumulate cash value.

Disadvantages of Conversion: While conversion offers flexibility, it also comes with higher premiums. Whole life insurance is significantly more expensive than term insurance, and once you convert, your premiums will reflect that. It’s important to consider if you can afford the increased cost of a permanent policy. If your financial situation changes, you may find the higher premiums difficult to sustain.

Limitations on Conversion: Some insurers may impose limits on the conversion amount. For example, if you have a $500,000 term policy, you may only be able to convert a portion of it to permanent coverage. You’ll want to review your insurer’s conversion guidelines to ensure that your desired coverage is available during conversion.

Should You Convert?: Converting a term policy into whole life can be a smart move if you need long-term coverage, but it’s not always the best option for everyone. If you’re mainly interested in coverage for the short term and don’t foresee a long-term need for life insurance, converting might not be the right choice. On the other hand, if you anticipate needing lifelong coverage or want to start building cash value, conversion provides an easy path to permanent insurance without the hassle of reapplying or undergoing a medical exam.

How Do Health Conditions Affect Term vs Whole Life Insurance?

When it comes to life insurance, your health condition plays a significant role in determining both your eligibility for coverage and the premiums you’ll pay. However, the impact of your health varies depending on whether you choose term life or whole life insurance, and understanding these differences can help you make a more informed decision.

Health and Term Life Insurance: Health conditions can have a big impact on your ability to qualify for term life insurance. Since term life policies typically don’t have a cash value component and are designed to provide coverage for a set period, insurers assess the risk of insuring someone for that term based on their health. If you have existing health issues or are a high-risk individual, your premiums for term life insurance may be higher, or you may even be denied coverage altogether.

Medical Exam Requirement: Most term life policies require you to undergo a medical exam as part of the underwriting process. During this exam, insurers will check key health markers like blood pressure, cholesterol levels, and overall physical condition. If you have chronic conditions, such as diabetes or heart disease, this could affect your eligibility or the rate at which your premiums are set.

Health and Whole Life Insurance: Whole life insurance can also be impacted by your health, but the effects are somewhat different. While a whole life policy also typically requires a medical exam, the permanent coverage aspect means that you will be covered regardless of your health status, as long as you continue paying your premiums. However, if you’re in poor health at the time of applying, the premiums will be considerably higher than if you were healthy.

Cash Value Accumulation and Health: With whole life insurance, a person’s health history can also impact the growth of the policy’s cash value. Healthier individuals tend to live longer, which allows the cash value to grow over time. On the other hand, someone with a serious health condition may face shorter life expectancy, which could affect how long the policy’s cash value accumulates. However, the death benefit in a whole life policy is guaranteed, so your beneficiaries will still receive the payout upon your death, regardless of your health.

Guaranteed Acceptance for Whole Life Insurance: Some whole life insurance policies, particularly guaranteed issue policies, don’t require a medical exam. These policies are generally available to individuals with serious health issues or those who may have been turned down for other types of insurance. However, these policies tend to have much higher premiums and lower death benefits. They also often have a waiting period before the full death benefit is paid out, which is something to consider if you have pre-existing health conditions.

Impact of Pre-existing Conditions: Pre-existing health conditions, such as cancer, HIV, or kidney disease, can affect your life insurance rates for both term and whole life policies. Insurers will assess the severity of your condition and how well it’s managed. If your condition is under control, you might still be able to get a standard policy, but if it’s severe or poorly managed, you may face higher premiums or be denied coverage entirely.

Premium Adjustments Over Time: With term life insurance, once you secure a policy, the premiums are typically fixed for the length of the term. However, if you renew the policy after the term ends or convert your term life to a permanent policy, the premiums may increase due to your age and health at the time of renewal. With whole life insurance, while your premiums remain stable, they may still reflect your health at the time of purchase.

Policy Conversion and Health Conditions: If you have a term life policy and your health worsens during the term, you may still have the option to convert it to a permanent policy (such as whole life) without undergoing a new medical exam. This can be a major advantage for individuals with deteriorating health who want to lock in lifetime coverage despite their health status.

Insurance for Seniors and Health: For seniors, obtaining life insurance can be more difficult, especially with pre-existing health conditions. However, both term and whole life insurance can still be available, though premiums tend to rise significantly. Guaranteed issue whole life policies are often the best option for seniors with health conditions, though they come with trade-offs in terms of coverage and cost.

Tax Implications: Term Life vs Whole Life

When it comes to life insurance, tax implications are an important consideration. While life insurance is generally tax-advantaged in many ways, the way it affects your finances varies depending on whether you have term life or whole life insurance. Understanding the tax benefits and considerations for both types of policies can help you make an informed decision.

Tax-Exempt Death Benefit: One of the key advantages of both term life and whole life insurance is that the death benefit paid to your beneficiaries is typically tax-exempt. Whether you have term life or whole life insurance, your loved ones will receive the death benefit without owing income tax on the proceeds. This tax-exempt nature makes life insurance an attractive way to pass on wealth to your family or heirs.

Whole Life Insurance and Cash Value: Whole life insurance has an added tax consideration due to the cash value component. The money that accumulates in the cash value of your whole life policy grows tax-deferred. This means that you won’t pay taxes on the growth of the cash value until you access it. The deferred tax treatment allows the cash value to grow without reducing its potential value through taxation, making whole life insurance a tool that can be used for long-term wealth-building.

Withdrawals and Loans: When you access your whole life policy’s cash value, there are specific tax rules to be aware of. If you withdraw money from the cash value, the amount withdrawn up to your basis (the amount you’ve paid into the policy) is tax-free. However, if you withdraw more than your basis, the excess amount is subject to taxation as ordinary income. If you take a loan against your policy’s cash value, the loan is generally not taxable, but interest will accumulate over time and may become due when the loan is repaid or deducted from the death benefit.

Dividends and Taxes: If your whole life policy is a participating policy (meaning it pays dividends), those dividends are not taxed when they are received. However, if you allow the dividends to accumulate and earn interest, the interest will be subject to taxes. Additionally, if you choose to take dividends in cash or use them to purchase additional insurance, the accumulated dividends may be subject to taxation at some point, depending on the tax laws in effect.

Term Life Insurance and Taxation: For term life insurance, the primary tax implication is the tax-free death benefit. Since term life policies do not have a cash value or investment component, there are no concerns about taxes on the policy’s growth, dividends, or loans. You simply pay your premiums, and your beneficiaries receive the death benefit tax-free upon your death.

Estate Taxes: While life insurance death benefits are typically free of income tax, they could still be subject to estate taxes if the proceeds push your estate above the taxable threshold. This could be a consideration if your estate is substantial. One way to minimize estate tax liability is to place the policy in an irrevocable life insurance trust (ILIT), which removes the death benefit from your estate and keeps it from being taxed.

Taxation of Policy Surrender: If you surrender your whole life policy and cash out the accumulated cash value, you may owe taxes on the surrender value. This applies if the cash value exceeds the total premiums you’ve paid into the policy. In this case, the gain is taxable as income. It’s important to be aware of the tax implications of surrendering a policy, as it could result in a significant tax bill.

Tax Considerations in Retirement Planning: Whole life insurance can also be used as a retirement planning tool. The cash value growth is tax-deferred, and policyholders may use the accumulated cash value to supplement their retirement income through loans or withdrawals. While these funds may not be subject to income tax when accessed in the form of a loan, they could impact your retirement income strategy if not managed carefully.

Using Term Life Insurance for Short-Term Needs

Term life insurance is especially suitable for short-term needs, making it a highly flexible option for individuals seeking affordable coverage for specific periods of life. Whether you’re protecting a family, securing a mortgage, or covering educational expenses, term life insurance offers a simple solution. Here’s how it can be used effectively for short-term purposes:

Temporary Protection: Term life insurance is typically structured to cover specific timeframes, such as 10, 20, or 30 years. This makes it ideal for protecting your family or finances during key life events, such as while children are young or while you’re paying off a mortgage. Once the term expires, you no longer need to pay premiums for the coverage, making it a cost-effective option for those who only need insurance for a limited period.

Cost-Effective for Young Families: If you’re in the early stages of your career or starting a family, you may have a higher need for life insurance protection but a limited budget. Term life insurance provides an affordable option to secure coverage during the most financially critical years of your life. You can buy a significant amount of coverage for a fraction of the cost of whole life insurance, ensuring that your family is financially protected without draining your resources.

Coverage for Major Financial Obligations: If you have significant financial obligations that are temporary in nature, term life insurance can help cover those risks. For instance, if you have a large mortgage, you may want to purchase term life insurance that covers the amount of the loan in case something happens to you. Similarly, if you’re paying for your children’s education, a term life policy can provide the necessary financial security should you pass away unexpectedly.

Supplementing Group Life Insurance: Many people have access to group life insurance through their employers, but group policies often offer limited coverage and may not be portable if you change jobs. Term life insurance can be purchased in addition to group coverage to ensure that you have the right amount of protection. This can be especially useful for those who have dependents or significant debts that need to be covered in case of an untimely death.

Short-Term Needs and Health: If you’re young and in good health, term life insurance is the most affordable option to meet your short-term needs. Premiums are relatively low, and coverage can be tailored to your specific needs. If you’re on a tight budget, term life allows you to get the protection you need without overstretching your finances.

Flexibility for Changing Needs: The flexibility of term life insurance is a key benefit. If your financial situation changes over time—for example, if you pay off a mortgage or your children become financially independent—you can adjust your coverage. You can also renew your term life policy if you still require coverage after the initial period, though premiums may increase.

No Cash Value Accumulation: Since term life insurance doesn’t have a cash value component, it is purely focused on providing a death benefit for a set period. This makes it less of an investment and more of a protective tool. If you’re only concerned with temporary coverage, term life’s simplicity and affordability are key advantages.

When to Reassess: It’s important to reassess your life insurance needs at regular intervals. If your short-term needs have been met, you may decide to cancel the policy or let it expire. Alternatively, if your financial responsibilities increase, you may want to convert or purchase additional insurance.

End of the Term: At the end of a term life policy, you’ll have options to renew, convert, or cancel your coverage. While renewing a term policy is often possible, premiums will likely increase due to your age and health. If you decide you still need permanent coverage, converting the policy to whole life could be a good option.

Whole Life Insurance as a Long-Term Wealth Strategy

Whole life insurance isn’t just a tool for life insurance protection—it can also be a key component of a long-term wealth strategy. For individuals looking to combine insurance coverage with an investment component, whole life offers the unique benefit of cash value accumulation. Here’s how whole life insurance can play a role in a broader financial plan:

Wealth Accumulation: One of the primary benefits of whole life insurance is its ability to accumulate cash value over time. The cash value grows on a tax-deferred basis, meaning you don’t have to pay taxes on the growth until you withdraw or take a loan against it. This makes whole life insurance an attractive option for individuals looking to build wealth in a conservative, stable way.

Guaranteed Growth: Whole life policies provide guaranteed growth in the cash value component, which gives policyholders a predictable return on their premiums. While the return might not be as high as market-based investments like stocks or mutual funds, the guarantee offers a sense of security for those looking for a stable, low-risk investment option.

Dividends as a Wealth-Building Tool: Participating whole life insurance policies pay dividends based on the insurance company’s performance. These dividends can be used to increase the cash value or purchased additional coverage, both of which help build wealth over time. While dividends are not guaranteed, they can be an important part of long-term financial planning.

Tax-Deferred Growth: The tax-deferred nature of whole life insurance’s cash value growth makes it an attractive option for those looking to supplement their retirement savings. The cash value grows without being taxed, and policyholders can access it in retirement without immediate tax consequences. This tax deferral allows for greater compounding and potentially higher returns over time.

Asset Diversification: As part of a diversified portfolio, whole life insurance can provide a hedge against other financial risks. For example, it’s not tied to the stock market, meaning it can be a safer asset during market volatility. Adding a whole life policy to your overall financial strategy can provide balance, especially if other investments are subject to market risks.

The Role of Riders in Life Insurance Policies

Riders are additions or modifications that can be attached to life insurance policies to tailor coverage to your specific needs. Both term life and whole life insurance offer a variety of riders that can enhance your protection. Understanding the different types of riders and how they work can help you personalize your policy and ensure it provides the right level of coverage for your situation.

What Are Riders?: A rider is an optional provision added to a life insurance policy that modifies or enhances the coverage. Riders allow policyholders to customize their policies to meet specific needs or circumstances. Riders are typically added for an additional cost, but the added flexibility they provide can be well worth the price for many individuals.

Common Riders for Term Life Insurance: While term life insurance is usually straightforward, it’s possible to add several riders to increase its benefits. Some common term life riders include:

Accelerated Death Benefit Rider: This rider allows you to access a portion of your death benefit if you are diagnosed with a terminal illness. This can help cover medical expenses or other costs while you’re still alive.

Waiver of Premium Rider: If you become seriously ill or injured and are unable to work, this rider will waive your premium payments, ensuring that your policy remains active even if you’re unable to pay.

Child Term Rider: This rider provides life insurance coverage for your children for a set term. It can be a cost-effective way to ensure that your dependents are covered.

Common Riders for Whole Life Insurance: Whole life insurance policies, given their permanent nature, often offer a wider range of riders that can add value over the life of the policy:

Guaranteed Insurability Rider: This rider allows you to purchase additional coverage at a later time without undergoing a medical exam, regardless of your health status at that time.

Long-Term Care Rider: Some whole life policies offer a rider that provides long-term care benefits. This can help you access a portion of your death benefit if you need to pay for nursing home care or other long-term care services.

Accidental Death Benefit Rider: This rider provides an additional death benefit if the insured dies as a result of an accident. It can increase the payout to beneficiaries in the case of accidental death.

Living Benefits Riders: Many life insurance policies offer living benefits riders, which allow you to access a portion of your death benefit while still alive in certain situations. These can include benefits for terminal illness, chronic illness, or critical illness. Living benefits riders are especially useful for individuals who want peace of mind that they will have financial support in case of serious health issues.

Cost of Riders: Adding riders to a life insurance policy usually increases the premium, but the cost is often relatively low compared to purchasing separate policies for specific needs. For example, a waiver of premium rider or accelerated death benefit rider may only add a small amount to your premium, but they can provide significant financial protection in the event of an illness or unexpected life event.

Evaluating the Need for Riders: When adding riders, it’s important to evaluate whether the benefits they provide align with your life stage and financial situation. If you are young, healthy, and have limited dependents, riders may not be necessary for you. However, if you have children or are planning for potential future medical needs, riders could enhance your policy’s flexibility and value.

Riders for Specific Needs: Certain life insurance riders are tailored to specific life circumstances, such as providing coverage for spouse or business partners. For instance, the spouse rider allows you to cover a spouse without purchasing an entirely separate policy. These riders are useful in cases where multiple people require coverage under the same policy.

Rider Availability: Not all riders are available with every type of life insurance or every insurer. Riders also come with terms and conditions, such as age limits or specific situations in which they can be used. When considering a policy, it’s important to verify which riders are available and how they apply to your personal or family circumstances.

When Should You Consider Term Life Insurance?

Term life insurance is designed to provide coverage for a specific period, making it an ideal choice for individuals with temporary needs. While it’s often more affordable than whole life insurance, it’s important to understand when term life insurance makes the most sense. Let’s explore the scenarios in which term life insurance is the best fit.

Young Families with Dependents: One of the most common reasons to consider term life insurance is to protect young families. If you have children or dependents, a term life policy ensures that if something happens to you, your loved ones will have the financial resources to cover living expenses, mortgage payments, or education costs. Many families purchase term life policies for 20 or 30 years to match the duration of their financial needs.

Covering Large Debts or Mortgages: If you have significant debts—especially a mortgage—and you want to ensure that your family is not burdened with these financial responsibilities, term life insurance is an affordable way to protect against this risk. A term policy that matches the length of your mortgage term can provide peace of mind, knowing that your family will be able to pay off the house if something were to happen to you.

Cost-Effective Coverage for Specific Needs: Term life insurance is the most affordable option for individuals who need significant coverage but have limited budgets. If you’re looking for temporary coverage—such as during your child’s college years or while you’re paying off debt—term life can provide the protection you need without the long-term financial commitment of permanent insurance.

When Health is a Concern: If you are in good health and looking for affordable coverage, term life insurance is a great option. Premiums for term life are lower than for whole life, and if you are healthy and young, you can lock in a low premium for a longer term. This makes it easier to get substantial coverage without straining your budget.

Short-Term Coverage Needs: If you need life insurance for a specific short-term situation, such as covering a business loan or ensuring your family is protected during your most financially vulnerable years, term life insurance provides a clear and concise solution. It’s also ideal for those who may not have any need for permanent coverage but want financial security for a defined period.

Financial Flexibility: Since term life insurance policies have a fixed term, they allow you to reassess your coverage as your financial situation evolves. As your children grow older, your mortgage is paid off, or your financial responsibilities change, you can adjust your coverage accordingly. This flexibility is particularly appealing for individuals with changing financial needs over time.

Avoiding Unnecessary Costs: If you don’t anticipate needing life insurance coverage after a certain age—such as after your children become financially independent or your mortgage is paid off—term life insurance allows you to avoid the ongoing costs of a permanent policy. This can save you money in the long run, especially if you don’t require coverage after a particular age.

Investment vs. Protection: If your primary goal is protection rather than investment growth, term life insurance is the better option. Unlike whole life, which has a cash value component, term life focuses exclusively on providing a death benefit. If you already have other investment vehicles, such as 401(k) plans or IRAs, and just need life insurance for peace of mind, term life is likely a better fit.

When You Don’t Need Cash Value: If you’re primarily concerned with securing life insurance protection and don’t want to pay for the investment component that comes with whole life insurance (the cash value), term life insurance is the better choice. You’ll only pay for the death benefit, without the additional costs of cash value accumulation or dividends.

When Should You Consider Whole Life Insurance?

Whole life insurance is a powerful tool for those seeking long-term financial security and wealth-building opportunities. While term life is great for temporary needs, whole life insurance is designed to offer lifetime coverage and financial growth. Here are several scenarios when you should consider purchasing whole life insurance:

Long-Term Coverage Needs: If you’re looking for insurance that will cover you for your entire life, whole life insurance is the best choice. Unlike term life, which expires after a set period, whole life policies last for the entire lifetime of the policyholder, provided the premiums are paid. This ensures that your beneficiaries will receive a death benefit no matter when you pass away. For those who want permanent protection, whole life is an attractive option.

Wealth Accumulation and Cash Value Growth: One of the most significant advantages of whole life insurance is the cash value accumulation. A portion of your premium goes into a savings-like account that grows on a tax-deferred basis. This can be an excellent way to build wealth over time, as the cash value grows and can be accessed through loans or withdrawals. If you’re seeking both protection and the opportunity for long-term financial growth, whole life insurance can be a key component of your strategy.

Estate Planning: Whole life insurance is commonly used in estate planning because the death benefit can help cover estate taxes and ensure that your loved ones inherit your assets without having to liquidate other property or investments. Since the death benefit is paid out tax-free, it can provide a financial cushion for your heirs, ensuring they don’t face a hefty tax bill when settling your estate.

Providing for Loved Ones: If you want to provide financial security to your loved ones for their entire lives, whole life insurance is ideal. It can cover final expenses, such as funeral costs, and leave a legacy for your family, ensuring they have a financial cushion to fall back on in the event of your death. The policy is particularly beneficial for people who want to provide for dependents, such as children with special needs or aging parents.

Supplementing Retirement Income: Whole life insurance can also act as a supplement to your retirement income. The cash value can be accessed through loans, and some policyholders use this strategy to generate income in retirement. While accessing the cash value through loans doesn’t incur taxes immediately, any unpaid loan amounts (including interest) will be deducted from the death benefit when the policyholder passes away. This makes whole life insurance an attractive long-term financial tool for those who are planning for retirement.

Creating a Financial Legacy: For individuals who want to create a legacy for their children, grandchildren, or favorite charities, whole life insurance is an effective way to do so. Not only can it help replace lost income, but it also serves as a means of building wealth that is passed down through generations. It’s especially valuable when you have substantial assets you want to protect and grow over time.

Tax Benefits of Cash Value Growth: The tax-deferred growth of the cash value component is another reason to consider whole life insurance. You won’t have to pay taxes on the growth of the cash value until you access it. This can make a whole life policy more attractive compared to other investment vehicles, which are often subject to capital gains tax or interest tax. The deferred tax status allows your policy to grow more efficiently over time.

Guaranteed Coverage: Whole life insurance offers the peace of mind that your premiums will never increase, and your coverage will remain in place as long as you live. Many people choose whole life insurance because they want the stability of knowing that their coverage will never expire, and their family’s financial future will be secured no matter when they pass away.

Flexibility of Policy Loans: With whole life insurance, you can take out loans against the cash value of your policy. These loans typically have low-interest rates, and you don’t have to repay them immediately. This flexibility can be a huge advantage in times of financial need, allowing you to access cash without selling assets or taking out traditional loans.

Real-Life Case Studies: Term vs Whole Life

To better understand how term life and whole life insurance work in real life, let’s explore a few case studies that highlight the practical applications of each type of policy. These examples will help illuminate the decision-making process and provide insight into how different individuals might choose one policy over the other.

Case Study 1: The Young Family with Debt

John and Sarah are in their early 30s and have two young children. John works as a software developer, while Sarah stays home with the kids. They have a $250,000 mortgage and plan to send their children to college in 15 years. They decide to purchase a 20-year term life insurance policy to protect their family in case something happens to John. The premiums are affordable, and the death benefit would cover their mortgage and future expenses.

John and Sarah are primarily concerned about protecting their children and paying off their mortgage, which they expect to be completed within the 20-year term. After that, they plan to reassess their life insurance needs. Given their temporary financial obligations, term life insurance makes perfect sense for them. It’s affordable and provides the coverage they need for the next two decades.

Case Study 2: The Business Owner with Long-Term Goals

Lisa, a 45-year-old entrepreneur, owns a successful marketing agency. She’s thinking about her long-term financial strategy and wants to ensure that her business and personal estate are well protected. Lisa is also interested in building wealth over time and passing on a financial legacy to her two children. After evaluating her options, she decides to purchase a whole life insurance policy. The policy will provide her with permanent coverage and accumulate cash value that she can access in retirement.

Lisa appreciates the fact that her policy’s premiums will remain fixed and that the cash value will grow tax-deferred. She also likes the idea of using her whole life insurance to supplement her retirement income and leave a substantial legacy for her children. The whole life insurance policy fits well with her long-term financial goals and estate planning needs.

Case Study 3: The Single Professional Looking for Affordable Coverage

Michael is a 28-year-old software engineer with no children and no major debts. He doesn’t foresee a need for permanent life insurance, but he wants to ensure that his family will be taken care of if something happens to him unexpectedly. Michael decides to purchase a 10-year term life insurance policy, as it’s affordable and offers coverage for the period during which his financial responsibilities may change.

Since he doesn’t have long-term obligations, Michael chooses a term policy that covers the next decade. This allows him to protect his family without committing to permanent insurance. As his career progresses and his financial situation evolves, he plans to reassess his insurance needs. The term life policy gives him the coverage he needs while keeping costs low.

Case Study 4: The Retiree with Estate Planning Needs

Barbara, a 65-year-old retiree, is focused on ensuring that her family won’t be burdened with estate taxes or final expenses. She has a significant estate, but she worries about leaving her children with the financial responsibility of settling her affairs. Barbara purchases a whole life insurance policy with a large death benefit, which will be used to pay estate taxes and other costs associated with her passing.

The policy provides Barbara with the peace of mind that her children will be financially protected. They can use the death benefit to cover any taxes owed, ensuring that the bulk of her estate can be passed down intact. The guaranteed coverage and cash value growth of whole life insurance make it an ideal solution for her needs.

How to Choose the Right Insurance Company for Term or Whole Life

Choosing the right insurance company for your life insurance policy is just as important as choosing the right type of policy. The insurer you select will play a crucial role in your experience with the policy, from the application process to claims and customer service. Here are some key factors to consider when choosing the right insurance company: